Williams Companies Stands Alone at the Altar; Crestwood Delevers and Soars

Williams Companies Stands Alone at the Altar

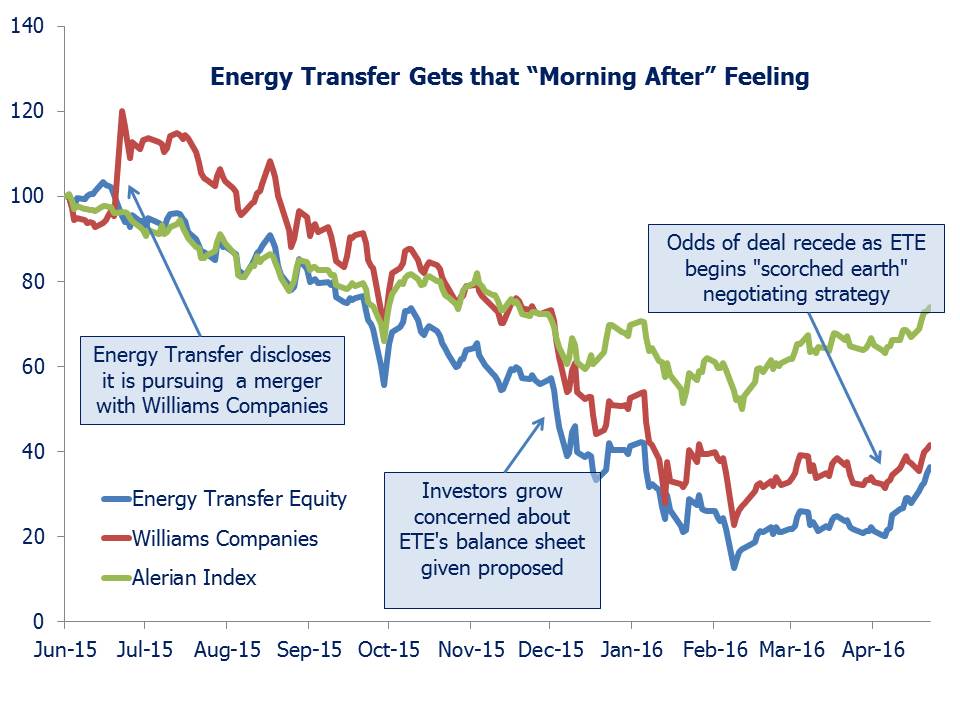

The Energy Transfer-Williams deal continues to be a rich source of intrigue and fascinating machinations. Sometimes a target company will try and get out of an agreement to sell itself so as to join with a more eager suitor. But it’s not often that an acquirer has second thoughts, and reading through a recent SEC filing by Energy Transfer reveals a blow-by-blow account of the frequent discussions of the William board as they considered their options.

As long ago as February 2014, Energy Transfer Equity (ETE) CEO Kelcy Warren had reached out to Williams Companies (WMB) CEO Alan Armstrong to discuss a combination. Armstrong was initially lukewarm and from the looks of it never became enthusiastic, even voting against the combination when it was finally considered by the WMB board in September 2015.

The “Background to the Merger” is in a section of a filing made, ironically, by Energy Transfer Corp (ETC), an entity created specifically to acquire WMB shares at closing but which for now is doing little more than posting SEC filings. Although ETC is currently controlled by ETE, its filing includes a methodical recital of the WMB board’s consideration of ETE’s offer as well as other competing proposals. Indeed, as the negotiations reached a conclusion WMB insisted on severely limiting ETE’s ability to walk away from the transaction. WMB sought to tighten the “material adverse effect” language that is commonly used and which allows a party to cancel a proposed transaction for no penalty in the event that a major surprise upsets the original economics. Kelcy Warren had pursued WMB for almost two years, and having finally succumbed to their eager paramour the WMB board was intent on making the deal stick.

Buyer’s remorse followed with indecent haste (see The Energy Transfer-Williams Poker Game). Within months ETE’s CFO Jamie Welch was reported to be privately lobbying WMB shareholders to press for modified deal terms, since the $6BN cash payment agreed to by ETE was weighing on the stock price. In fact, the performance of both stocks has been disastrous since the deal was announced, since the new ETC stock with which WMB investors would be paid was to be linked to collapsing ETE, thereby diminishing the value of the sale. It became obvious why ETE wanted out – less clear why WMB insisted on completing a transaction whose value had disintegrated. In May of 2015 ETE’s proposal to WMB had valued the stock at $64. By March of 2016 the prospect of the deal closing had dragged WMB down to $15. By then, Kelcy Warren had fired his CFO (who has sued) and gone nuclear in his efforts to get the deal changed or cancelled; ETE made a possibly illegal and certainly unethical move when they issued preferred equity only to insiders on preferential terms (thus devaluing the currency WMB investors would receive in the transaction, and drawing a WMB lawsuit). In case ETE’s distaste for the transaction wasn’t already clear, they subsequently posted an SEC filing slashing the originally expected $2BN in annual commercial synergies to only $170MM. For good measure they added that the combined company’s presence at WMB’s current headquarters in Tulsa, OK would be substantially reduced.

At this stage both stocks are attractively valued if they remain separate. So it’s interesting to learn how comparatively easy it is for the deal to be broken if the acquirer doesn’t wish to proceed. The merger-arb funds and the journalists who bet on a closing missed this. The New York Times reported on March 4th that, “…the company’s options appear to be severely limited.” With respect to breaking the deal, last week’s S-4 from Energy Transfer Corp noted that their tax counsel might not be able to deliver a needed tax opinion in time, a necessary condition for closing. One can imagine that if the acquirer doesn’t want to proceed, and an affirmative tax opinion is required from its legal counsel, it shouldn’t be difficult to delay or even fail to obtain such an opinion. Originally WMB didn’t want to be bought and ETE gave chase. Having finally been caught, WMB desires consummation while ETE claims its earlier passion has gone. WMB is at the altar while ETE nurses the mother of all hangovers in a hotel. Did they find each other on Match.com? In this upside-down world of love professed, only to be returned unrequited, it must be difficult for WMB to press a damages claim. Since the abovementioned filing cast further doubt on the deal WMB’s stock has risen. In any event, on June 28th either party can simply walk away. For Kelcy Warren that date probably can’t come quickly enough. The next target of his affections may run a little faster.

Crestwood Delevers and Soars

On Thursday Crestwood Equity Partners (CEQP) announced a joint venture with Con Edison which placed a 13X EBITDA multiple on the part of CEQP that was rolled into the JV and allowed them to use cash proceeds from the deal to reduce leverage. It was another example of public market equity prices underpricing the value that other energy sector investors assess to be present. Although CEQP jumped over 50%, we believe it’s still attractively priced with a 14% yield following a distribution cut, 1.6X distribution coverage and leverage dropping to <4X by year end. We noted the potential value in CEQP in February (see The Math of a Distribution-Financed Buyback)

Sell-Side Shockers

Meanwhile, MLPs have since February kicked off the casket lid and leapt up, showing vigorous signs of life. Many formerly wealthy MLP investors who hung on are no doubt relieved to be restored from potential mobile home dwellers to at least the category of mass-affluent. Sell-side coverage of the sector is becoming more cautiously constructive, buoyed by the Alerian Index finally reaching positive territory year-to-date. We came across one amusing recommendation from a clearly overworked analyst whose bosses evidently decided to issue an emergency research piece initiating coverage on MLPs. The hapless analyst breathlessly rates Columbia Pipeline (CPGX) “Market Perform”, failing to consider TransCanada’s (TRP) recently agreed acquisition of CPGX for $25.50 in an all cash deal. So regardless of how the market performs CPGX is going to $25.50. The same analyst thinks WMB investors will suffer a 50% dividend cut if the merger with Energy Transfer goes through, overlooking the 1.5274X ETE exchange ratio they’ll receive for their WMB shares. Who says sell-side research isn’t worth reading?

We are long CEQP, ETE and WMB in our mutual fund and separately managed accounts.

Chart source: Yahoo Finance

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!