We’re All Crude Oil Traders Now

Pioneer Natural Resources (PXD) was dubbed “The MotherFracker” by David Einhorn last May at the Ira Sohn Value Investing Conference. Einhorn is bearish on PXD and other E&P companies that use hydraulic fracturing to release crude oil from shale formations because he calculates that after properly accounting for their capital investment they don’t grow their reserves or generate free cash flow. We have no position in PXD and no view on Einhorn’s bearish call. PXD has lost roughly half its value from its high is the Summer of 2014 and has also fallen sharply since Einhorn’s presentation last May. Like the Alerian Index, PXD has followed crude oil lower.

The other day an investor presentation from PXD caught our attention, in part because PXD executed a $1.4BN secondary offering. We never like it when a company issues new equity following a substantial fall, and I doubt PXD investors were happy about it either. But it shows there is money available to domestic E&P companies in spite of plummeting crude oil.

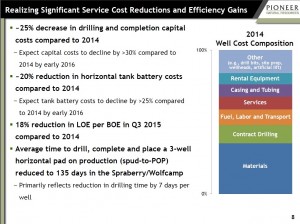

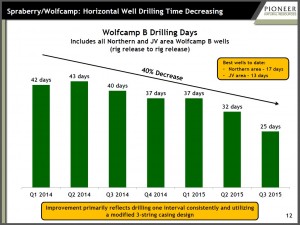

Part of the reason probably relates to the continued operating efficiencies being squeezed out by companies such as PXD. As the charts from their December presentation show, costs have been falling 18-25% over the past couple of years; time to drill a well has fallen 40%. As a result, they increased production by 12% last year.

Whether or not this is good for the oil market, it can’t be bad for the energy infrastructure companies that gather, process and transport their output. It highlights the resilience of the domestic E&P industry to the collapse in crude.

Not every E&P company looks like Pioneer though, and crude production is falling in North America as U.S. output expected to be lower this year versus 2015 with both the Bakken in North Dakota and Eagle Ford in south Texas contributing to the drop. Canadian producers in Alberta have long struggled with limited options to get their output to market. This is why the Keystone pipeline is such a big deal for them. The limited transport options mean Alberta crude trades at a substantial discount to the benchmarks, and it recently dropped below $20 a barrel which has caused some wells to be shut in rather than fail to cover even their operating costs. Reports indicate a reduction of more than 35,000 barrels a day of output from two producers.

At this point I imagine the discussions over crude oil strategy within the Saudi government must be heated to say the least. The stubborn refusal of large swathes of non-OPEC production to collapse is opening an enormous hole in Saudi Arabia’s budget as well as many other countries. If the Saudis have a strategy, it requires substantial optimism to find examples of its eventual success. What they need is a face-saving way to shift gears; to declare victory and leave the battlefield. They produced 10 million barrels a day in November and around 25% of this is consumed domestically. Assuming they receive $30 a barrel (their grades of crude are typically subject to a few dollar discount) and it costs them $5 a barrel to produce, they clear $188 million a day on the 7.5 million barrels they export. If they claimed that their strategy had been a success and were therefore announcing a one third reduction in exports, the loss of 2.5 million barrels of supply would cause the global oil market quite a jolt. A $12.50 jump in crude would see Saudi oil revenues unchanged. It’s a thought experiment, but with crude this low some odd things become possible.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

The Saudi’s strategy is political, not economic, as they are engaged in proxy wars with Iran and, to a lesser extent Russia. The Saudi’s seek to weaken their opponents’ ability to finance military adventures in the region of the Saudi sphere of influence and thus far have been quite willing to accept the economic pain of that decision. Of course the Saudis could at any time call a meeting of OPEC (and perhaps others), cut a deal to trim all exports by 10% and the market would snap right back to perhaps $60/bbl. Instead the Saudis are openly considering raising cash through an IPO of Aramco properties, suggesting that they are a long way off from cutting a production deal that benefits Iran and Russia. Is all of this economically rational? No! Is it politically rational? Depends on your point of view.