Wall Street Needs More Clients Like Tetra

Once again a corporate executive team has demonstrated childlike innocence when dealing with the hard-nosed providers of equity capital. Tetra Technologies (TTI) is the latest firm to combine a good business with a clueless approach to funding it. TTI supports the oil and gas industry, providing a wide array of products and services including fluids, compression equipment, well-testing and decommissioning. They are as much part of the Shale Revolution as the E&P companies that drill for oil and natural gas.

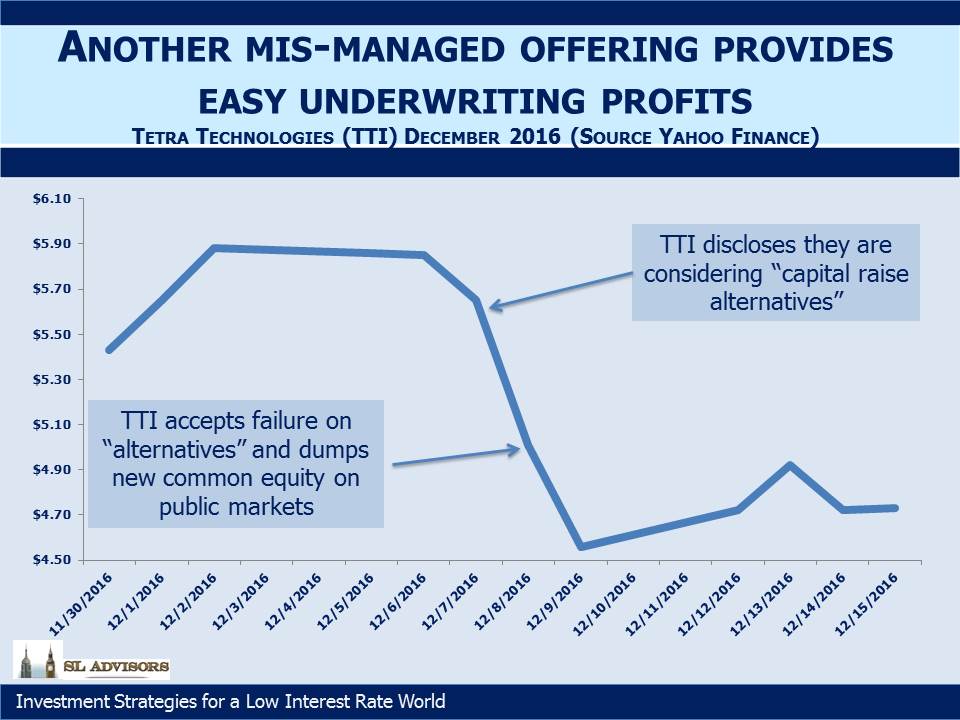

TTI decided they needed some additional equity capital as they were in danger of violating one of their debt covenants. On December 8th they issued a press release noting that the company was “…considering capital raise alternatives to strengthen its balance sheet.” They blamed potential weakness in 2017 Gulf of Mexico activity along with the delay of certain projects from 4Q16 into early next year.

The phrase “capital raise alternatives” clearly includes more than one type of capital, and strongly suggests that the simplest form, a public equity offering, was not the most likely outcome. A reasonable guess would have been a private placement of some type of preferred security convertible into common. TTI stock duly fell as investors digested both the slowdown in revenues from certain projects and the likelihood of some additional equity dilution.

On December 9th, TTI then surprised the market by announcing a generously priced secondary offering of common equity. The 19.4 million shares (expected to be upsized to 21 million) along with 10.5 million warrants represented a substantial 33% increase of the share count, a hefty dilution for existing shareholders.

TTI’s poor handling of the offering weakened their stock price, requiring the issuance of more shares than was otherwise necessary in order to raise the desired amount of capital. To see how this is so, consider the two announcements they made twenty four hours apart.

Their first press release, on December 8th, was pointless unless they had secured capital in some form. Companies don’t have to disclose that they might raise capital. A company is always interested in raising capital if the terms are attractive. Most likely TTI believed they were sufficiently close on agreeing terms that the desired “capital raise alternatives” were pretty much done. Their stock price fell on the news.

Consequently, the announcement of a public offering the following day communicated that the presumed private capital raise implied in the prior release had fallen through. In fact, it’s highly likely that the potential investors watched TTI stock plummet after the first anouncement, and concluded that they needed more generous terms. The price of TTI now had to reflect that private equity investors had considered an investment and passed.

There was no point in the first press release. All it did was to weaken their negotiating position and eventually force them into a dilutive public offering. CEO Stuart Brightman was paid $2MM last year but only has around $3MM in TTI stock, so the market’s response to his poor handling of the capital raise didn’t cost him very much personally.

Wall Street underwriters (in this case JPMorgan and Wells Fargo) are blessed to have such incompetent clients. It makes their jobs much easier.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!