U.S. Oil Output Continues to Grow

We’re in earnings season again, and last week we listened to US Silica’s (SLCA) conference call on Wednesday morning. Weakness in MLP prices due to softer crude oil is incongruous with the positive outlook communicated by SLCA’s CEO Bryan Shinn. Volumes and pricing were both up 15% quarter-on-quarter, with sand volumes in their Oil and Gas segment up 79% versus a year ago.

The continued innovation in shale drilling extends to varying the grades of sand used and generally quantities too. Moreover, while some analysts are concerned about overcapacity in the sand industry, CEO Shinn noted that because different grades of sand are not easily substituted, total supply capacity needs to be 20-25% greater than demand in order for the market to clear. He noted projections of 100 million tons (MT) of demand in 2018 (up from 75 MT this year), versus optimistic 2018 supply estimates of only 90 MT.

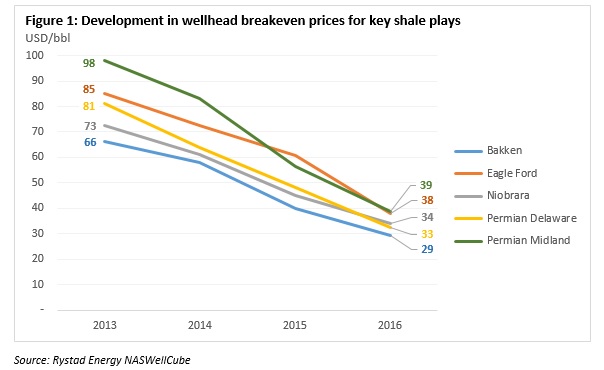

To SLCA, higher prices will be needed for the market to balance. U.S. shale drillers, who are the customers of MLPs and consumers of sand, show every sign of continuing to increase production. Breakevens continue to fall, with costs coming down another $10 per barrel across many shale plays over the past year. Shell’s CEO recently noted that break-evens in the Permian Basin in West Texas were $40 per barrel. This will support ongoing demand for the infrastructure and support MLPs provide.

The shale industry is producing more, while MLP investors remain nervous about the price of crude oil (see MLP Investors Not Yet Convinced).

Meanwhile, the International Energy Agency noted that global oil discoveries and new projects fell to historic lows last year with 2017 expected to offer little improvement. For three straight years exploration spending has been half of what it was in 2014. They contrasted the sharply reduced investment spending in the conventional oil sector with resilience of the U.S. shale industry.

Oil has been very volatile over the past three years, swinging from a high of $106 per barrel in June 2014 to $26 in February 2016. Historically, both supply and demand have been fairly inelastic which has resulted in fairly modest shifts in producer/consumer behavior translating into large price moves. The supply response function has historically been slow; if the world suddenly needs another 1 million barrels a day, there isn’t a dormant oil field that can be suddenly switched on. From discovery to production with a conventional field is years. Similarly, if supply is just a little more than the world needs (as was the case in 2015) it takes quite a price drop to induce a supply reduction.

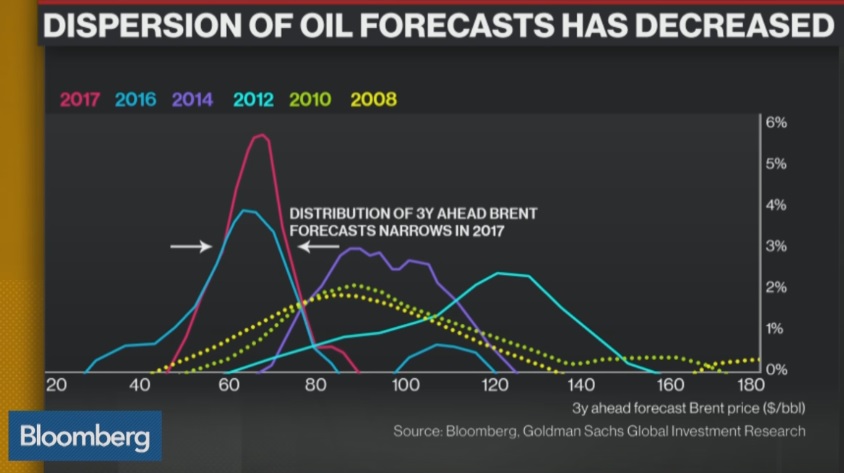

Conventional oil (and gas) projects are long cycle. By contrast, U.S. shale is short cycle in that wells can be drilled inexpensively and begin producing within months, with the high initial production rates allowing faster payback of capital invested. The availability of short cycle oil projects should make the supply response function shorter, which in turn should reduce the volatility of oil. This is why Exxon Mobil and other major energy firms are redirecting their capital spending (see Why Shale Upends Conventional Thinking).

Our thanks go to good friend and client Gerry Gaudet for directing us to the chart above. It compares the dispersion of oil forecasts in recent years, and the range is the narrowest in a decade. In other words, market participants are converging on a narrower likely price range for oil price as they incorporate the growing role of short cycle, U.S. shale into their supply models. This greater certainty is also likely to flatten the price curve for oil and perhaps even cause it to invert to backwardation (i.e. future prices lower than current), at least until something happens to upset these forecasts. One inference (apart from unexciting times for oil traders) is that projects with a breakeven much above $80 a barrel are going to be hard to finance since so few forecasters expect that high a price.

We are invested in SLCA

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!