There's More to Pipelines Than Oil

If I had $1MM for every time an MLP investor has asked me where crude oil is going, well I could probably buy a good chunk of Plains All American (PAA), the biggest crude oil pipeline operator in the U.S.

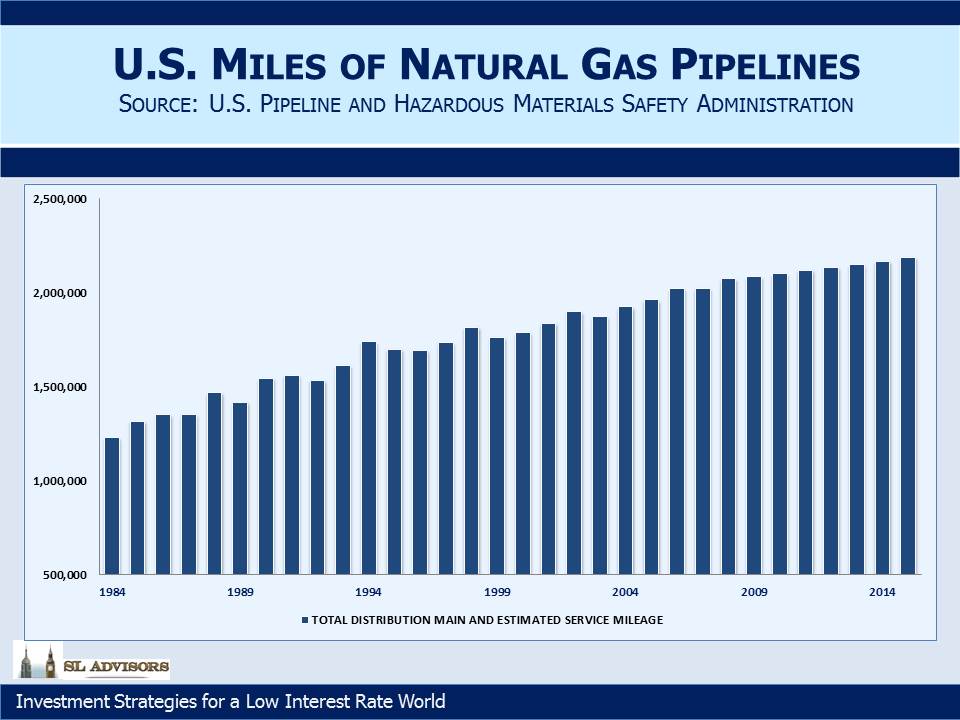

But PAA aside, MLPs are not as closely aligned with crude oil as popularly believed. The charts below show in raw numbers how many miles of U.S. pipelines are dedicated to crude oil, refined products, Natural Gas Liquids (NGLs) and natural gas. We have over 2 million miles of transmission capacity for natural gas. While a good portion of that travels the last few yards to a residence or business, almost 1.3 million miles is classified as “Distribution Main” mileage. On pure miles of pipeline, natural gas swamps anything else. Their owners are diverse and include utilities as well as MLPs. The network of gas pipelines has been growing, to accommodate America’s increasing use of natural gas for heating, electricity generation and other industrial uses.

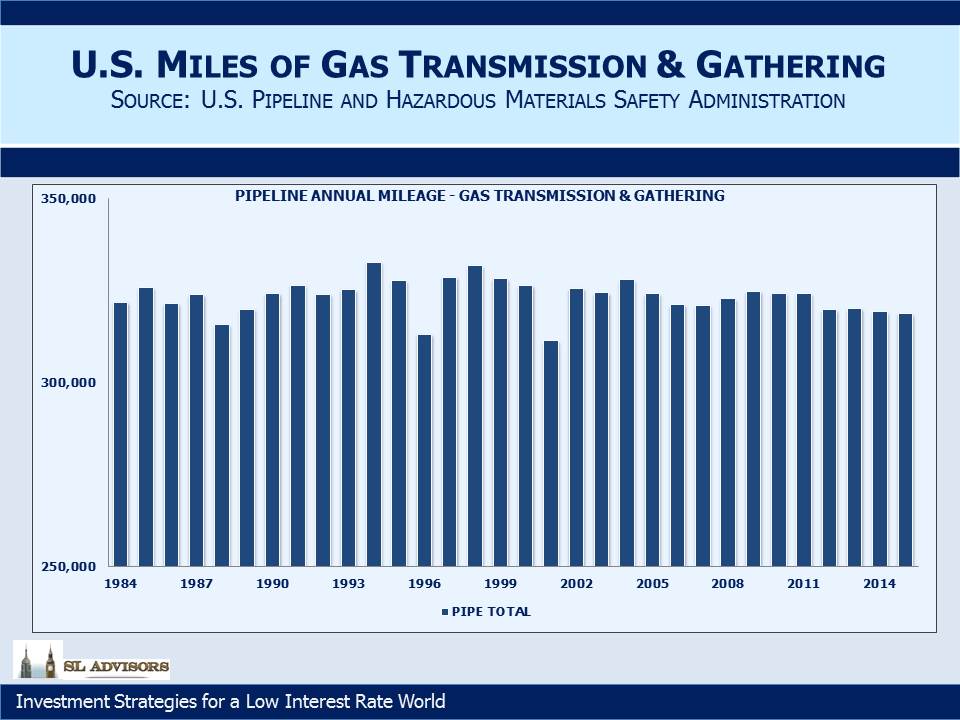

The Energy Information Administration (EIA) counts 300,000 miles of inter-state and intra-state transmission pipelines which are largely controlled by MLPs.

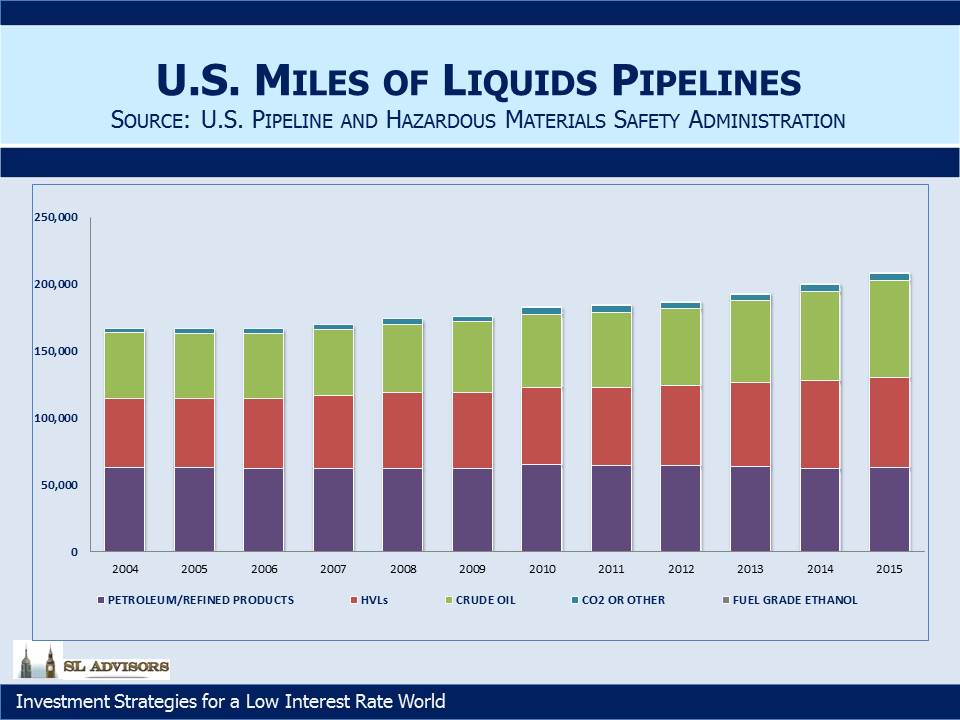

We have over 200,000 miles of pipelines carrying hazardous liquids, which are roughly evenly split amongst petroleum/refined products, NGLs (referred to as HVLs) and crude oil. The last two categories have been responsible for the growth in this sector.

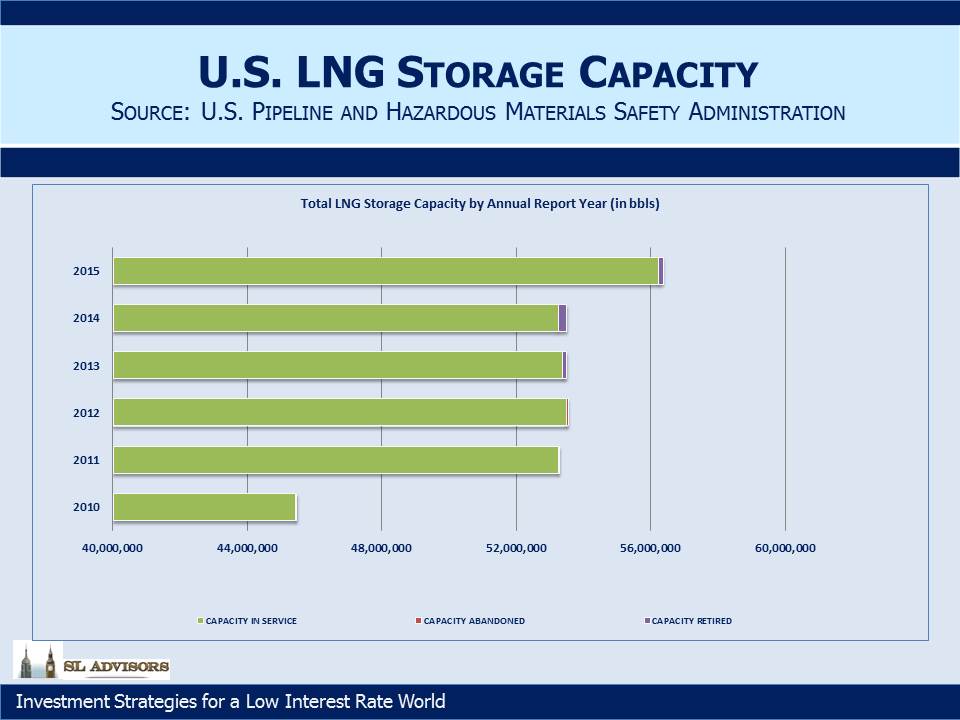

We’re also storing more NGLs too, and the chart below shows a recent jump in storage capacity (measured in Millions of Barrels).

Meanwhile, spending on new infrastructure has continued although the 2015 MLP Crash did lead to the deferral of some projects. There have also been some notable cancellations because of the often complex approval process. Kinder Morgan (KMI) halted their North East Direct project because they were unable to obtain enough capacity commitments. This was in part because in Massachusetts there’s no financial incentive for a utility to secure long term supply, which limited their interest in signing up for pipeline capacity. Access Northeast, another effort to improve distribution and storage for New England under the direction of Spectra Energy (SE), may also be cancelled for similar reasons. A surprising consequence is that Boston now imports Liquified Natural Gas (LNG) by ship for use in winter, even while the U.S. is beginning to export it. LNG has to be liquefied for storage and regassified for use, a not trivial expense borne by the helpless consumers in the region.

It’s not uncommon to hear energy sector executives complaining about the present Administration and their opposition to fossil fuels. The increases in crude oil and natural gas production over the past eight years weaken the case for critics, although the drawn out and eventual cancellation of the Keystone pipeline project did not reflect an enlightened energy policy. More recently, the Dakota Access Pipeline (DAPL) project run by Energy Transfer Partners (ETP) has been the victim of some hostile and possibly illegal moves by the Administration. It is too long a story to recount, but a good description is on Forbes (see Why The DOJ Order To Shut Down Construction On The DAPL Pipeline is Legally Indefensible). While the opposition to new projects such as this hurts many unwitting participants including consumers who’d benefit from cheaper energy, such difficulties can only enhance the value of existing infrastructure. Given the unpredictability of the approval process as shamefully on display in the DAPL case, a new build looks ever more daunting compared with extracting higher returns out of existing assets.

In fact, on this point we recently ran across a very old documentary (sometime in the 1950s) highlighting the Transcontinental Gas Pipe Line Corporation as it traverses from Texas north through the eastern U.S. to New York City. If you have twenty five minutes to spare it’s worth watching. It reminds how energy infrastructure has a useful life of decades and is in many cases impossible to replicate as communities develop around and over it. Today Transco, as it is called, belongs to Williams Companies (WMB).

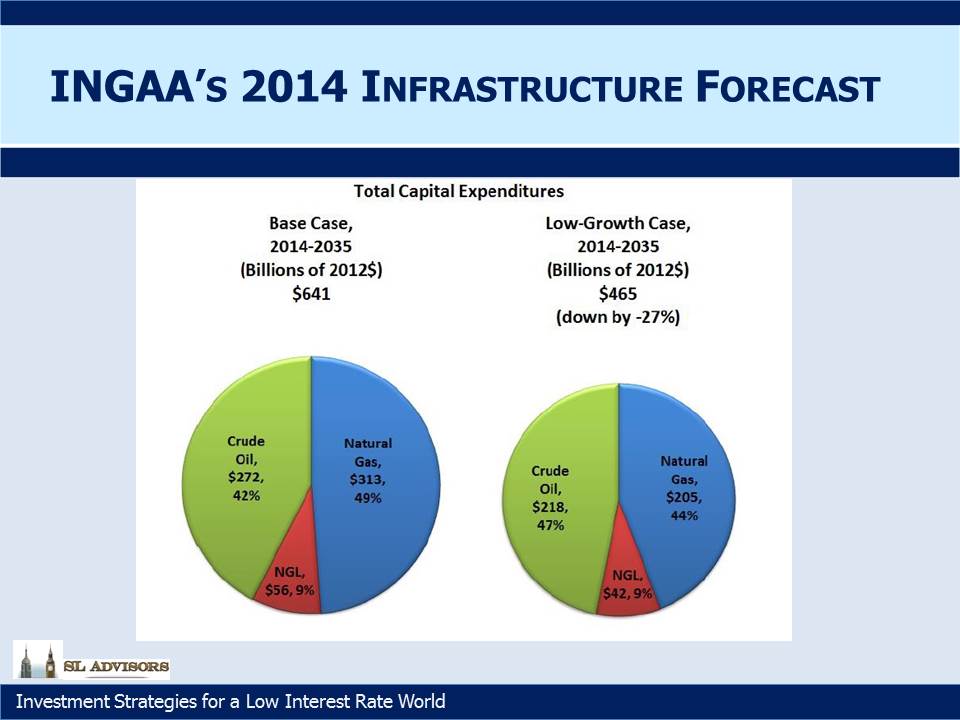

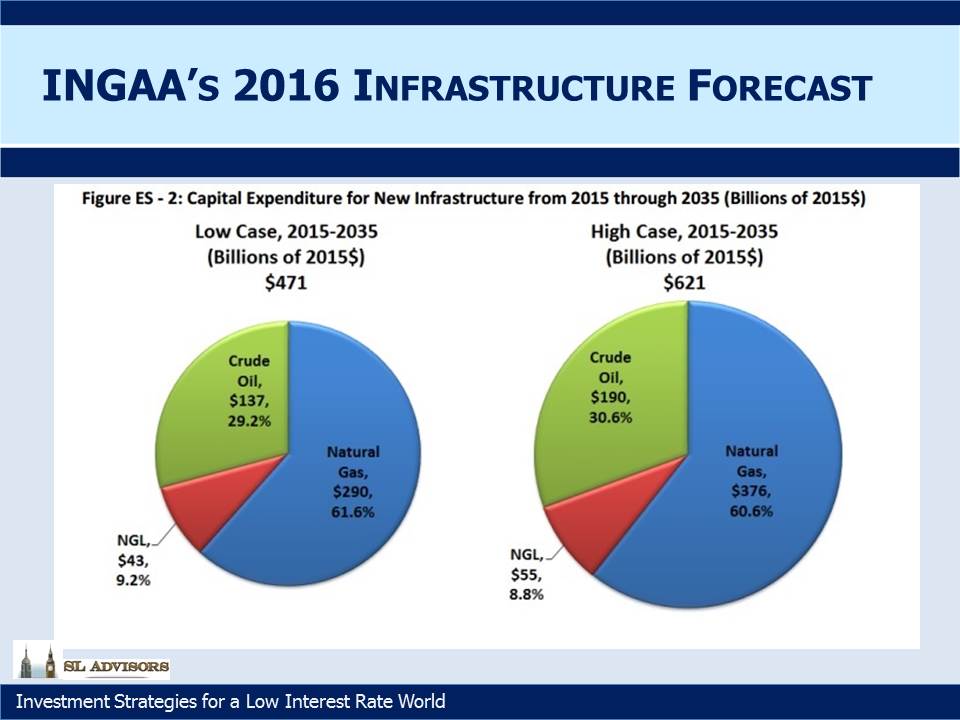

What has changed over the past couple of years is that the planned new infrastructure dedicated to natural gas has grown while crude oil projections have fallen, as forecast by the Interstate Natural Gas Association of America (INGAA). The charts below compare 2014 and 2016. The prospect of MLPs investing approximately two times their current market capital in new projects over the next twenty years hasn’t been much altered. MLPs and crude oil are gradually disengaging (see MLPs and Crude Oil, the Improbable Dance Partners). Just as hedge fund asset growth is good for hedge fund managers, MLP asset growth should be good for MLP General Partners. At a time when the Federal Reserve continues its benign interest rate policy of wealth transfer from savers to borrowers (see The Shrinking Pool of Cheap Assets), MLPs remain one of the few asset classes to offer attractive valuations.

We are invested in KMI, SE and WMB

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!