Oil and Gas Output to Reach Records Next Year

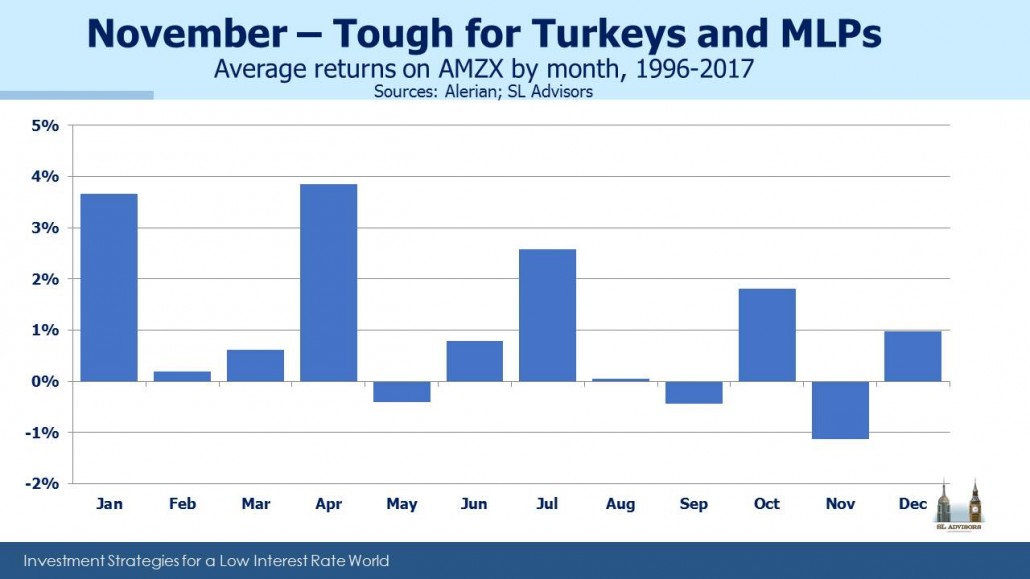

Seasonal patterns can be interesting when there’s some plausible substance driving the relationship. For several years we’ve noted the persistence of November to be weak, with the best returns occurring early in the calendar year (see Why MLPs Make a Great Christmas Present). The predominance of individual investors (rather than institutions) in the sector accounts for much of this. Most of us probably take stock of our investments around year-end, perhaps enjoying a welcome break from overindulgence at the dinner table. Any resulting portfolio shifts therefore take place shortly after.

K-1s are another factor; if you’re thinking of selling a publicly traded partnership, why wait until January when you’ll receive another K-1 for the partial year. Similarly, if you’re contemplating buying, you might as well delay until January so as to avoid a K-1 for the last part of the year. In both cases this leads to more sellers than buyers late in the year and the reverse in January.

Every year there are reasons to suppose that the seasonals won’t work. We’ve written many times that MLPs have lost the support of their traditional investor base, and that energy infrastructure corporations (“C-corps) are now as big as MLPs (see The American Energy Independence Index). So that may dilute the impact of individual tax-driven decisions over time. Anecdotally though, there has certainly been some individual tax-loss selling recently. Returns ex-energy have been strong, and some investors are booking losses in MLPs to offset other taxable gains.

But it’s also true that those not invested in energy infrastructure are far more numerous than those who are. As despondent as today’s investors may be, we have regular conversations with others with capital to commit who see potential opportunity in attractive valuations and the beaten down sentiment of existing holders.

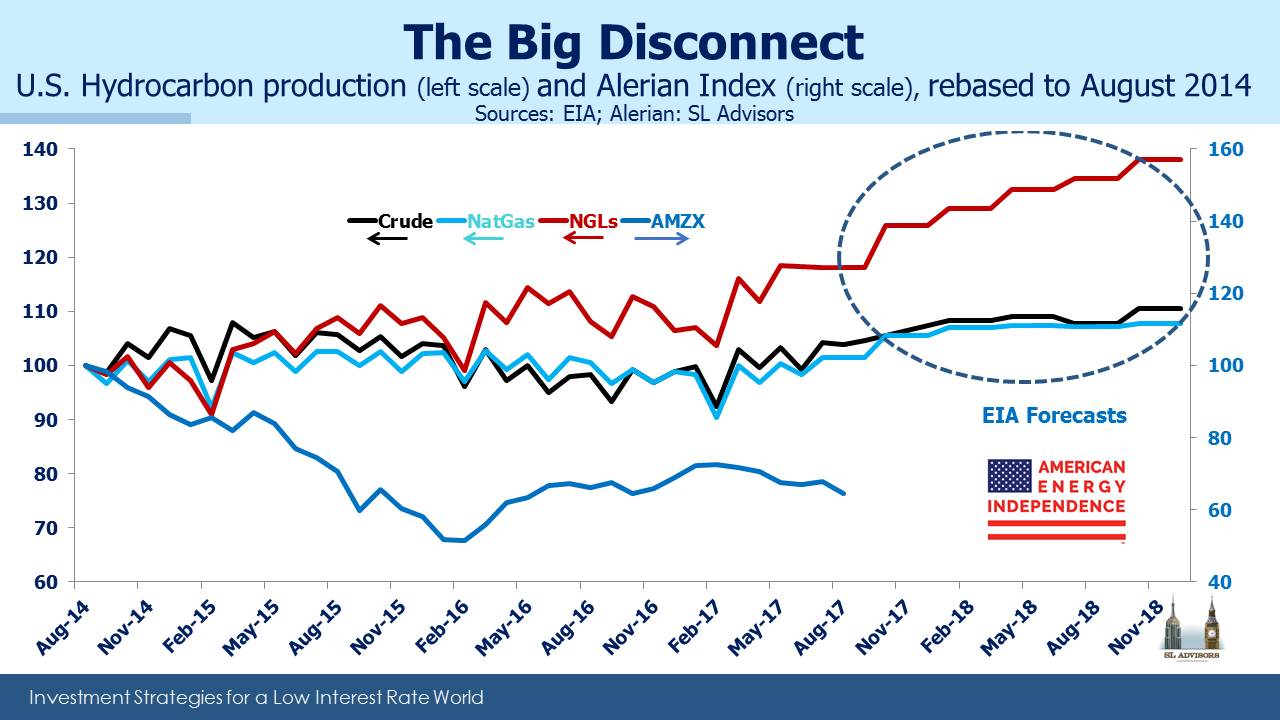

The second chart captures the common refrain of investors frustrated by growing U.S. hydrocarbon production that so far hasn’t raised stock prices for the energy infrastructure businesses that support it. They’re right. Since the August 2014 peak in the sector, production levels have recovered and are now higher than they were three years ago. A recent report from the Energy Information Administration (EIA) forecasts record output next year in crude oil, natural gas and Natural Gas Liquids (NGLs). The Alerian Index has disconnected from this volume growth, in part because traditional investors were alienated by the distribution cuts to fund growth and reduce leverage that many businesses undertook (see Why the Shale Revolution Hasn’t Yet Helped MLPs). But the volumes are certainly coming. Today’s investors are getting paid with attractive distributions to wait for new investors to respond to the opportunity. The seasonal pattern may yet provide the catalyst.

On a different note, long-time readers will be aware of our disparaging comments about non-traded REITs, a nasty little security with no legitimate place in a retail investor’s portfolio because of the exorbitant fees charged (up to 15% of an investor’s money). Three years ago in one warning blog about the sector, we referenced American Realty Capital Properties founded by Nick Schorsch (see A Scandal That Should Shock Nobody). Former CFO Brian Block was recently sentenced to 18 months in prison for six counts of fraud. If your advisor recommends non-traded REITs, it may be because they’re more in his interests than yours.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

I cannot understand the passionate dislike for K-1s exhibited by investors. K-1s have a very positive factor in that they assist long term investors to keep current on their adjusted basis in units they own. And why defer buying a worthwhile MLP at a good price in December merely because of getting a K-1? Because there won’t be any basis adjustment (since there’s no tax deferred distribution in December), all it will show is the unadjusted cost basis, so there’s nothing to be afraid of.

Elliot, I agree with you. But we routinely hear of accountants advising clients to “avoid K-1s” without any consideration of the economics for the client even after figuring in the cost of tax preparation. Few investors bother to study the impact. And you’ll recall last year ETP gave “Depreciation Units” to ETE in exchange for IDR waivers (you’ll likely recall our blog post, https://sl-advisors.com/looks-good-true/). In our opinion this demonstrated that few even among K-1 investors examine their after-tax return, since ETE judged the transfer of depreciation from ETP to ETE was unlikely to harm ETP’s valuation.