The Global Trade in Natural Gas

One of the many benefits of the Shale revolution has been a reversal of the U.S. terms of trade with respect to natural gas (see U.S. Natural Gas Exports Taking Off). We’ve long been a net importer and the Sabine Pass LNG (Liquified Natural Gas) facility in Louisiana was originally intended to augment pipeline inflows with waterborne imports. The discovery of so much commercially viable and cheap domestic natural gas upended these plans and several years and billions of dollars later Sabine became the first of several LNG export facilities.

Owner Cheniere Energy (LNG) just announced their 100th LNG shipment. One of the most stunning developments in this arena has been LNG shipments of natural gas from the U.S. to the United Arab Emirates (see Coals to Newcastle). You have to be pretty good at producing it cheaply in order to cover shipping costs to a region of the world awash in hydrocarbons. And in America, we are.

Natural gas pricing has always been a much more local market than is the case for crude oil. This is because moving natural gas long distances generally requires a pipeline. Seaborne shipments involve chilling gas which is expensive. Consequently, shipping costs for gas are typically a far larger proportion of the value of the commodity than is the case for crude oil, which is why you’ll hear reference to a global crude market but rarely one for natural gas.

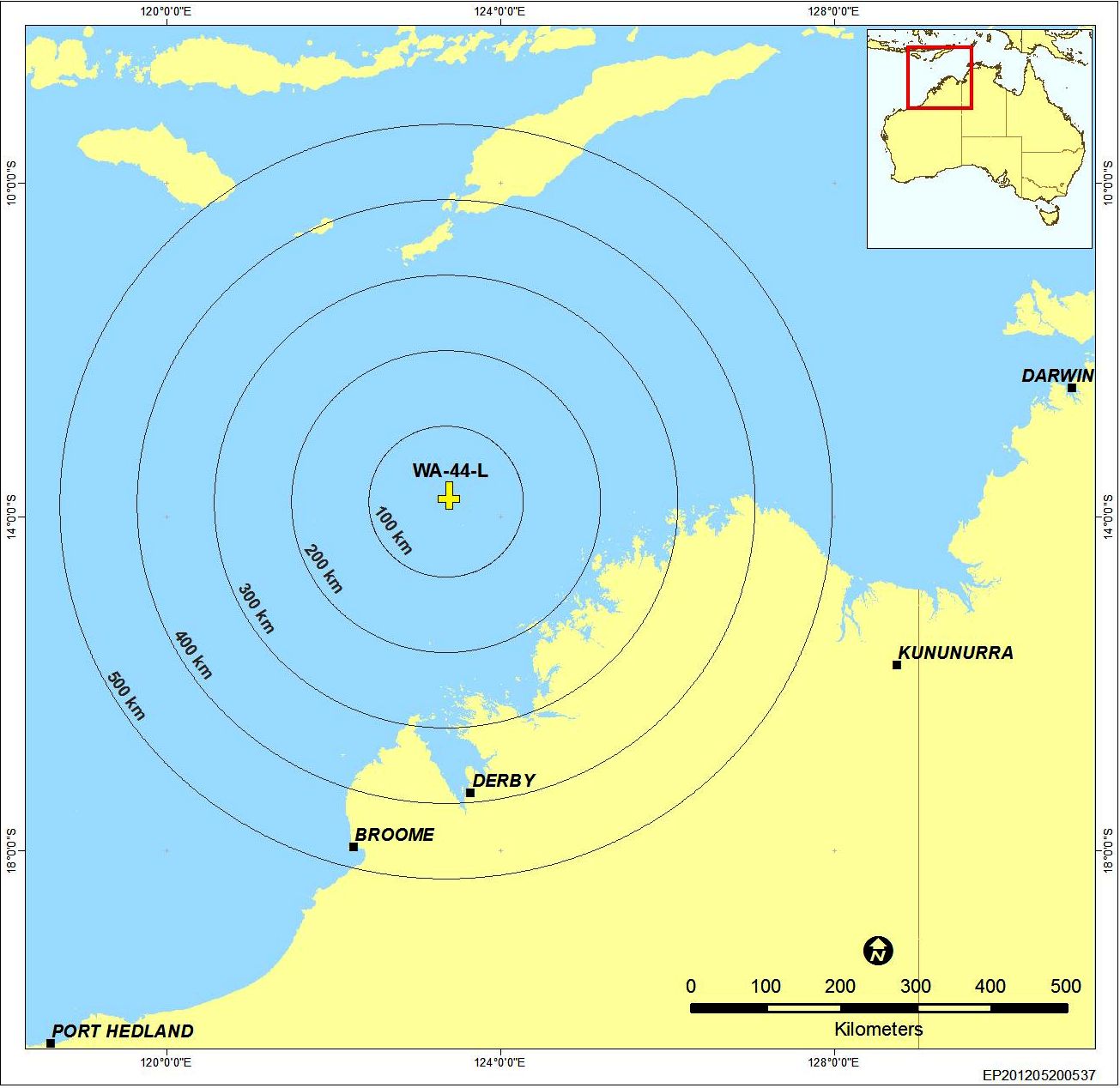

However, this is beginning to change and the commencement of U.S. LNG exports last year is part of this new trend. Although the U.S. is currently an insignificant player, our exports are set to grow steadily in the coming years. Qatar is the world’s biggest exporter but is expected to be passed by Australia next year, which has ten LNG projects at various stages of production. One of the most extraordinary LNG projects currently underway involves liquefying natural gas that is sourced from beneath the seabed around 125 miles from the coast of Western Australia. Shell Australia is building a floating LNG facility called Prelude FLNG.

Prelude’s construction involves components from all over the world. The hull has been built in Geoje, South Korea, one of the very few shipyards in the world big enough to accommodate it. Other key components have been built in Malaysia, Dubai and France. Shell’s website has some interesting videos on the project.

Some numbers will illustrate: at 533 yards, it is longer than four English football pitches (or five American football fields). When complete, it will weigh as much as six of the largest aircraft carriers combined. It will be tethered permanently to the floor of the Indian Ocean, designed to withstand a 1 in 10,000 year typhoon (let’s hope that’s right). When chilled to -260 degrees Fahreinheit, LNG occupies 1/600th of the volume it would in a gaseous state. Prelude’s production could more than fully meet the needs of Hong Kong.

Shell’s Final Investment Decision (FID) to proceed with the project was made back in 2011 and construction began the following year. It’s safe to say the arrival of U.S. LNG exports on the market was not a factor that received much attention during Prelude’s planning. Natural gas prices around the world are lower than was the case when much of today’s LNG export facilities were initiated.

Only last year Woodside Petroleum cancelled a planned A$40BN FLNG project in the same area because of depressed commodity prices. But Shell has pressed ahead, and when in operation later this year Prelude will confront a changing world landscape. Japan has become a more significant buyer following the Fukushima nuclear disaster, which at one point led to a halt in output at all of the country’s nuclear power facilities. China is also seeking to shift away from coal to cleaner sources of electricity generation.

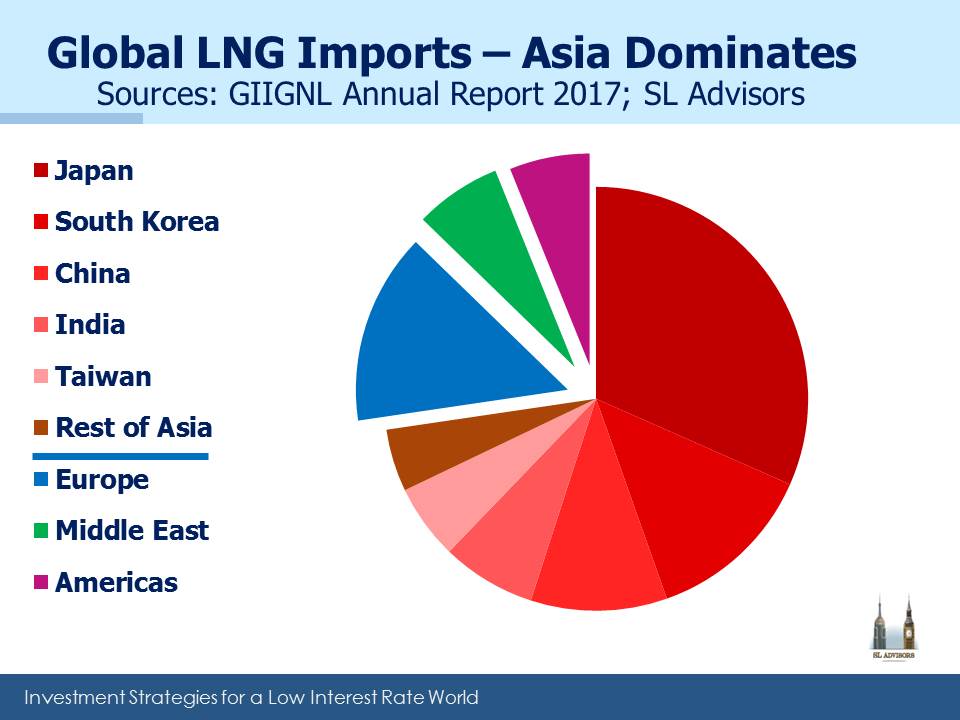

Australian LNG exports chiefly supply China, Japan and South Korea. In fact, as the pie chart shows, imports of LNG predominantly go to Asia which in 2016 received 73% of the world’s total LNG shipments. The global trade in LNG grew 7.5% from 2015 to 2016, up from an annual growth rate of 0.5% over the prior four years. China’s imports jumped by 37% and India’s by over 30%. 72% of LNG trade in 2016 was conducted under long term contracts (defined as greater than four years). LNG trade requires substantial capital investment, so supply/demand certainty is sought by both sides. Altogether, 39 countries import LNG from 19 exporting ones.

Although there are enormous technical challenges in building an FLNG facility, there are some benefits too. Prelude’s location will allow it to draw over 13 million of gallons of water every hour from the ocean to help cool the natural gas it’s processing. And the fact that it’s offshore means that the permitting process need not be quite so concerned with the consequences of a catastrophic failure as with land-based facilities.

All these developments are leading towards increasing trade in natural gas and the concurrent development of a global market, pulling together the many regional ones.

We are invested in Cheniere Energy (LNG)

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!