The Changing MLP Investor

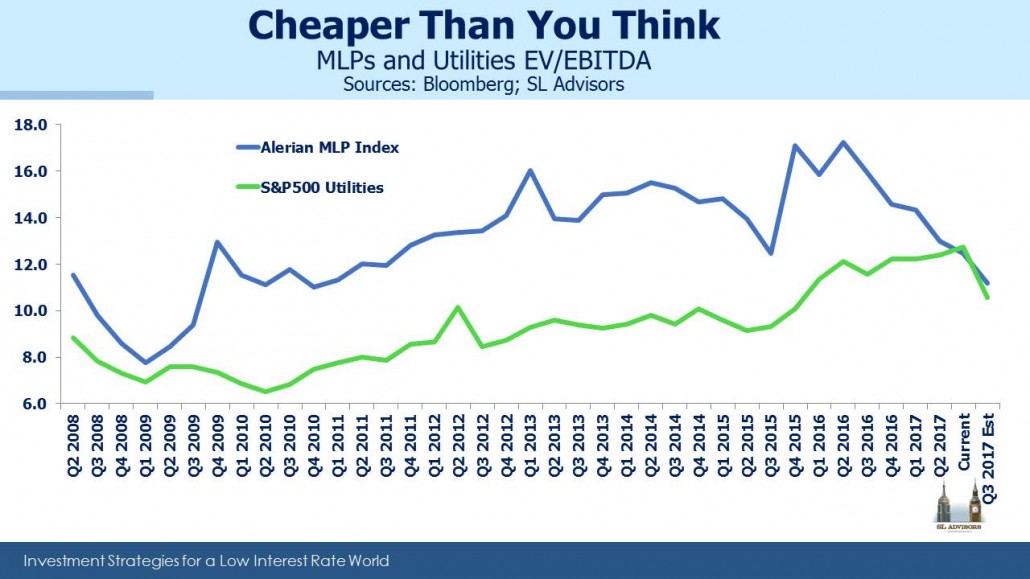

Why aren’t MLPs performing better given the fundamentals? On valuation, they should be compelling. Using EV/EBITDA (Enterprise Value /Earnings Before Interest, Taxes, Depreciation and Amortization), they are virtually on top of utilities, a point not reached either in 2008 or 2016.

Typically, MLPs are valued at a higher multiple. Although like utilities, they depreciate their assets, unlike power plants, pipelines buried underground typically appreciate, since their cashflows grow. They also have more flexibility in their customer base, since a pipeline can move hydrocarbons from anywhere that’s connected by the network. The customer base of a utility is geographically fixed. And EBITDA generated by a utility is subject to taxes, whereas MLPs don’t pay tax. For all of these reasons, EV/EBITDA multiples for MLPs are usually higher. Consequently, when relative valuations approached one another as they have twice briefly in the past decade, a sharp recovery in MLPs followed.

The yield on the Alerian MLP Index is currently 7.8%, 5.6% above the ten year treasury and substantially wider than the 15 year average of 3.5%. Moreover, MLP debt is performing far better than their equities, suggesting no particular financial distress.

2Q17 earnings were largely uneventful, with the dramatic exception of Plains All American (PAGP) which warned of a likely distribution cut (see MLP Investors Learn About Logistics). Management teams report that business is fine, cashflows growing and product moving. At some point in the next year we’re likely to see U.S. crude oil production exceed 10 Million Barrels per Day, a record last seen in November 1970. Yet MLPs fall when crude prices are weak and seem indifferent when they rise. What is going on?

MLP investors originally signed up for high, stable distributions with modest growth and not much excitement. The widely-hated K-1s provide a useful tax deferral for those willing to hand them off to an accountant. The tax benefit accumulates over time, creating a powerful incentive to delay selling which would make the tax bill come due. Some MLP investors really do hold forever, or at least their lifetimes, leaving their heirs to benefit from a stepped-up cost basis that wipes the tax slate clean. In a world of trigger-happy equity analysis with a relentless focus on the next few days or hours, MLP investors are what every company says they want: in for the long term.

There is increasing evidence that this stable investor base has been turning over. The Shale Revolution created the need for more infrastructure to support America’s drive to energy independence. It’s a truly exciting story that exemplifies much that is great about the U.S. (see Why the Shale Revolution Could Only Happen in America). But quite a few managements in their drive to seize the ensuing growth opportunities have imposed an unwelcome financial model on their loyal investor base. Stable distributions with low growth were put at risk with increased leverage seeking faster growth. The result, as Kinder Morgan showed, was that the MLP structure doesn’t work if you’re big and need to fund large capital projects.

The consequence for Kinder Morgan Partners (KMP) investors was an unwelcome tax bill as their units were absorbed by Kinder Morgan Inc. (KMI), and ultimately two dividend cuts. KMI recently announced they’ll be raising their dividend next year, since their backlog of new projects is a fraction of what it was three years ago and so they have more cash available to resume higher payouts (see What Kinder Morgan Tells Us About MLPs). But the psychological damage to KMP investors has been done. Every financial advisor I talk to has some clients who owned KMP and were effectively betrayed. They never signed up for higher leverage in search of faster growth, but the stewards of their capital decided for them. The experience has made many long-time MLP investors wary of being seduced by valuations into committing new capital.

KMI was only the first. Other companies, including Targa Resources (TRGP), Plains All American (PAGP), Oneok (OKE), Williams Companies (WMB) and Energy Transfer (ETP) have undertaken various types of structural simplification. In every case, it was a result of growth that strained balance sheets and it ultimately led to a cut (sometimes two) in distributions to MLP investors, an unwelcome tax bill or both. PAGP warned of an impending second distribution cut earlier in the month. The most loyal investors in the public equity markets have had their trust abused by management teams whose choices ultimately risked the stable payouts their clients had always sought. Although no reliable figures exist on this topic, several MLP executives have admitted to substantial turnover in their investor base in recent years. Income seeking investors did not sign up for this. The 58.2% drop in the Alerian Index from August 2014 to February 2016 remains a recent, highly unpleasant memory. When combined with multiple cases of broken distribution promises, many long-time MLP holders feel abandoned. The investor base is changing.

That is what is creating the current valuation opportunity. Today’s investors in energy infrastructure like the yields but are also fine with cash being reinvested back in the business, something MLPs did on a much smaller scale in the old days. Recent buyers recognize the opportunities to grow cashflows through enhancing existing assets and building new ones at attractive IRRs. The Shale Revolution is a tremendous opportunity for energy infrastructure businesses to generate stable and growing cashflows for many years ahead. But financially, getting there has been highly disruptive for an investor base originally not much concerned with growth. This transition from one type of investor to another isn’t happening smoothly, but it’s happening. Valuation discrepancies such as the EV/EBITDA comparison with Utilities won’t last forever.

We are invested in Energy Transfer Equity (General Partner of ETP), KMI, OKE, PAGP, TRGP and WMB

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

I don’t think that EV/ EBITDA is an ideal measurement of whether an MLP is undervalued or overvalued, since the EV component depends upon market cap and that is often highly irrational , predicated on whims and caprices of traders and not based on fundamentals. I prefer to look at yield as a metric to determine the relative value of an MLP. Based on yield there are many bargains around. I do recognize that yield is also dependent on the market price of units but I see that as a way of measuring opportunity.

Elliot, thanks for your comment. Both yield and Enterprise Value (EV) reflect market cap. The problem with yield is that it doesn’t adjust for variations in distribution coverage. For this reason, Distributable Cash Flow (DCF) yield would be preferable to Distribution yield. But neither of these adjust for different levels of leverage, whereas EV implicitly does. That’s why I think you’ll find EV/EBITDA (in which EBITDA is a proxy for pre-tax, pre-cost of debt financing, free cash flow) is often used, not just with MLPs but other asset-intensive businesses.

Total return on O&G MLPs is getting clobbered. I hate to have the core asset driven down even while the dividends are good.

I believe that the drivers are for core asset erosion are the growth of wind & solar power. I know that big tech strides are being made in the wind and solar areas, as well as electric vehicles.

The problem with financial analysis, EBITDA et al, is that it is backward looking. It’s Ok when the foreseeable future is much like the past. That is no longer the case.

Lots of suppositions. Changing investor base? What is your evidence? Also suggesting rollups are a reason with investors to flee seems a stretch. Only 2 are complete and most buyouts have been the LP buying out the IDRs a la MWE, MMP, EPD.

As for KMI, lots of issues with Richard Kinder. He has a history of questionable deals.