It’s Iran’s Move

If one thing’s clear about recent developments in the Middle East, it’s that events defy prediction. Yet timing trades in the energy sector requires the seemingly impossible.

On Monday, we listened to a thoughtful call arranged by RW Baird with Greg Priddy, Director, Global Energy and Middle East, at Stratfor. Greg expects a measured, near term response from Iran intended to be regarded as proportional, allowing for a similar U.S. response (i.e. target a couple of Iranian missile installations), and thereby avoiding escalation. It sounds very neat, and prone to miscalculation.

Greg Priddy felt that the virtual collapse of the Iranian nuclear deal is more problematic over the long run. In its first response to the killing of General Suleimani, the government announced that, “Iran will continue its nuclear enrichment with no limitations and based on its technical needs.” As Iran approaches an offensive nuclear capability, this is likely to draw a response from Israel or the U.S. He put the timeframe as by the summer, which struck us as startlingly soon. Priddy placed the odds of a significant U.S. military attack on Iran this year at 45%.

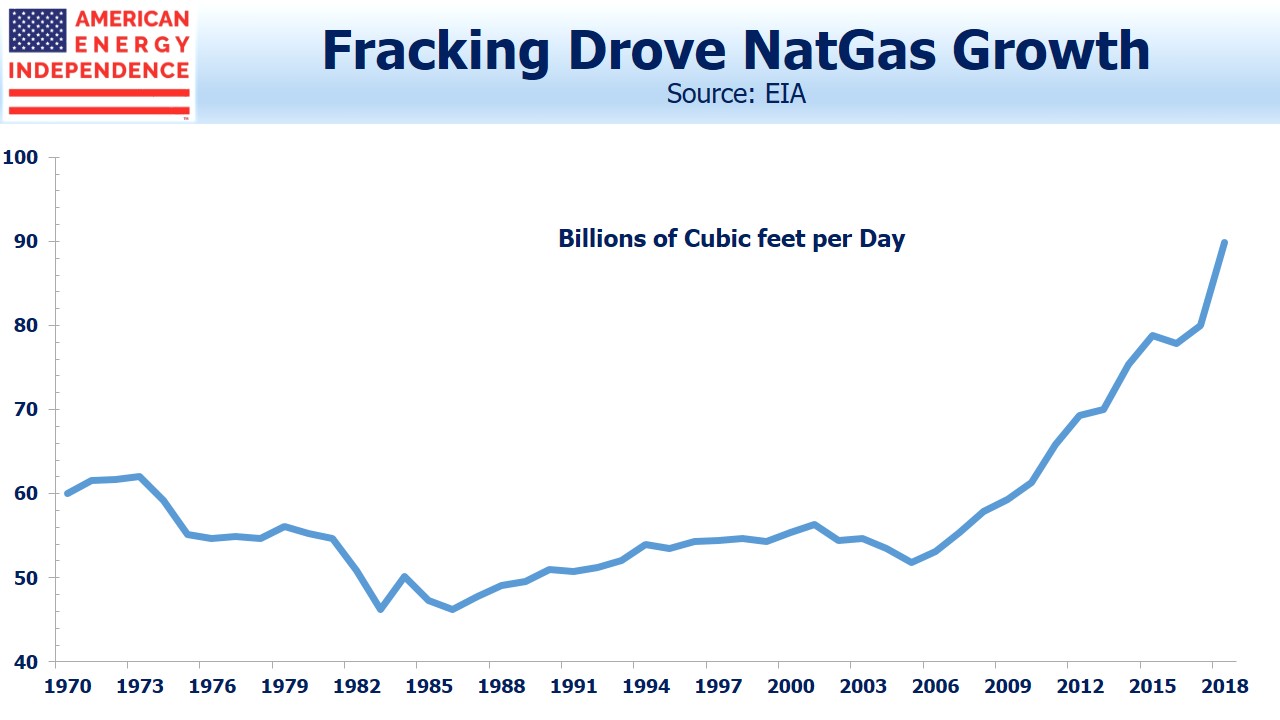

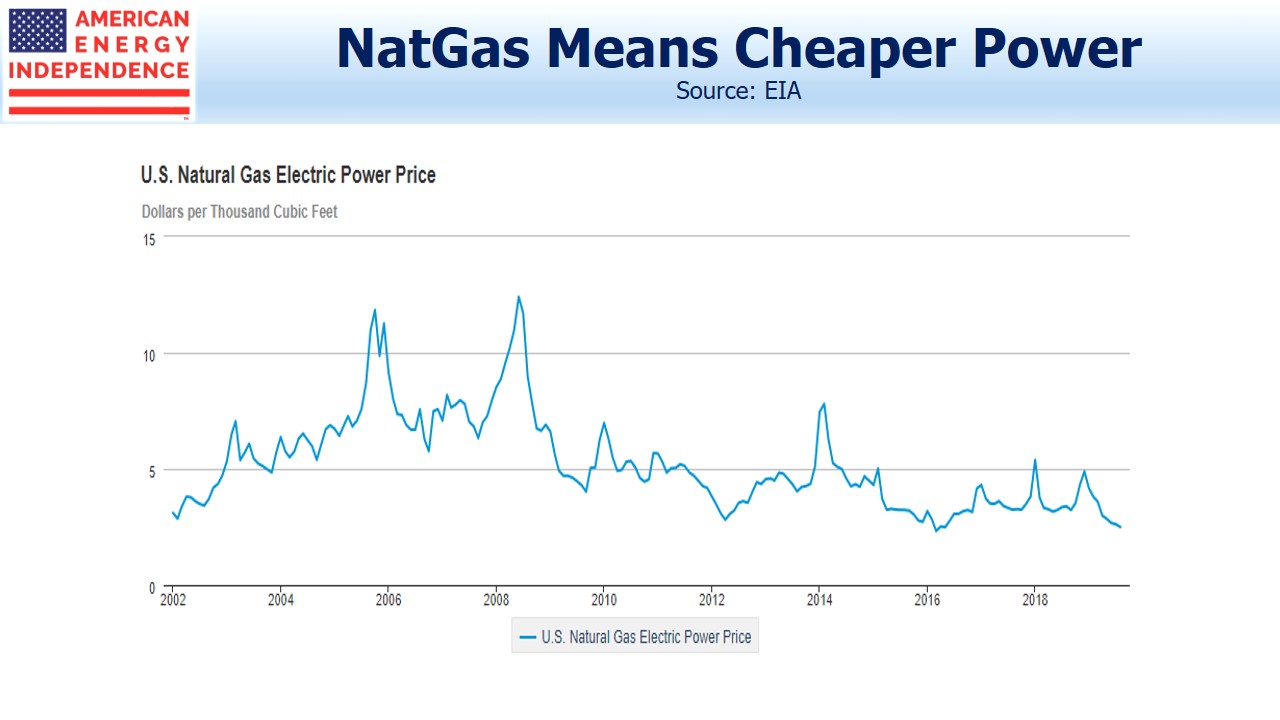

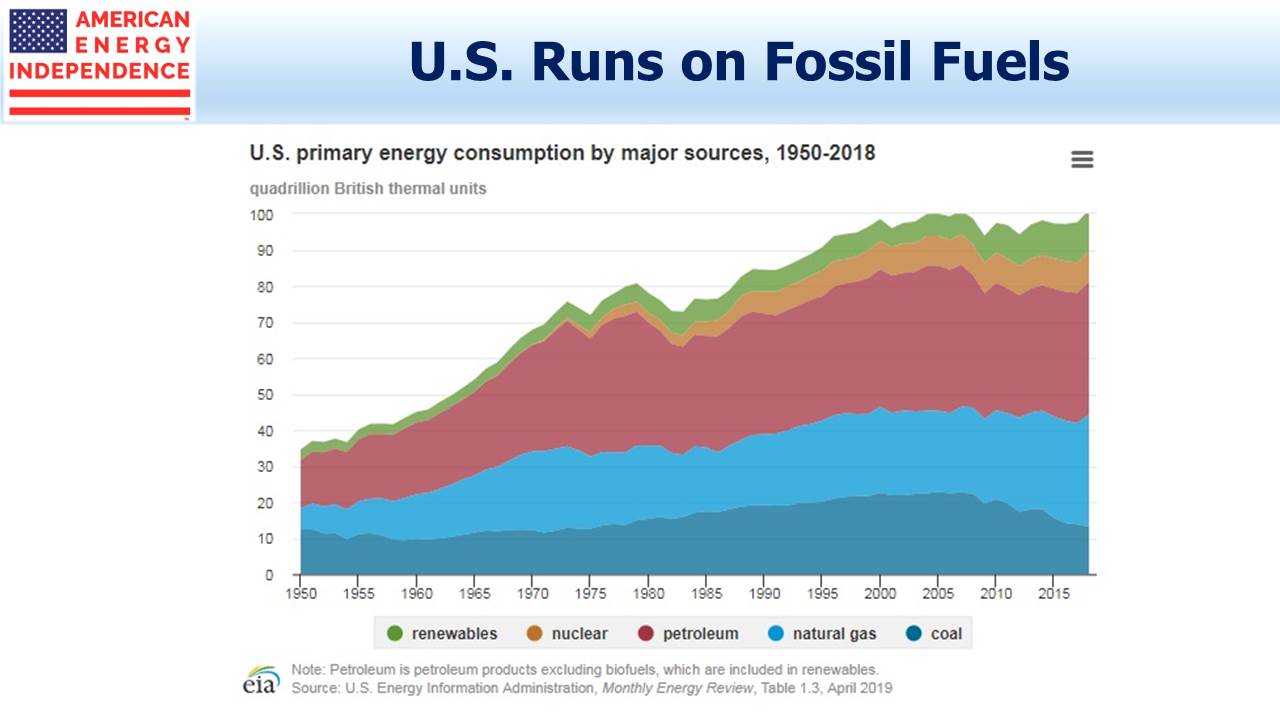

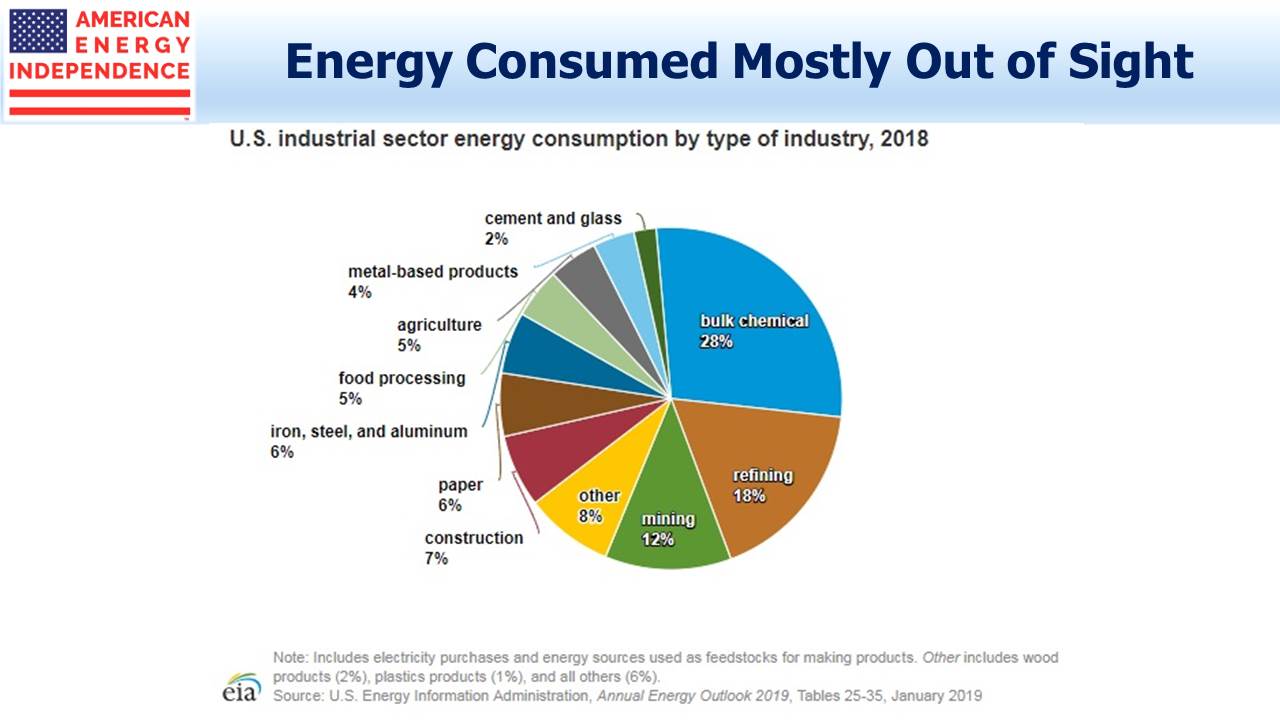

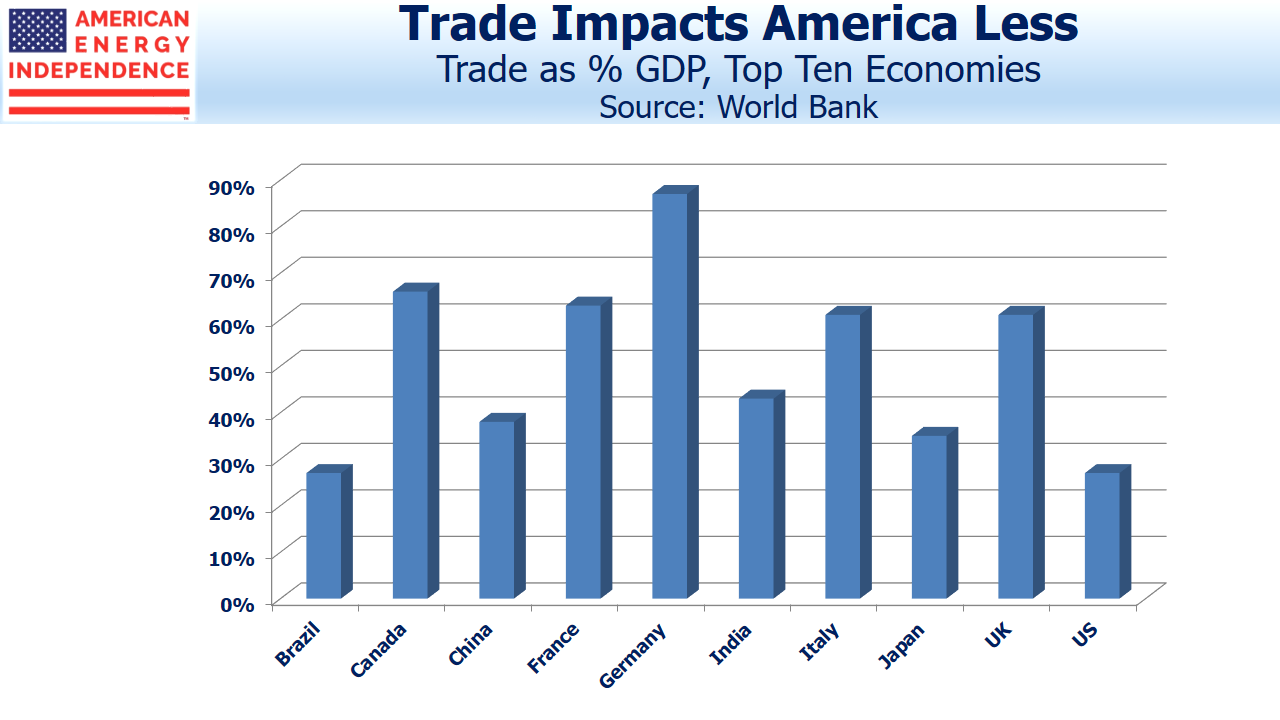

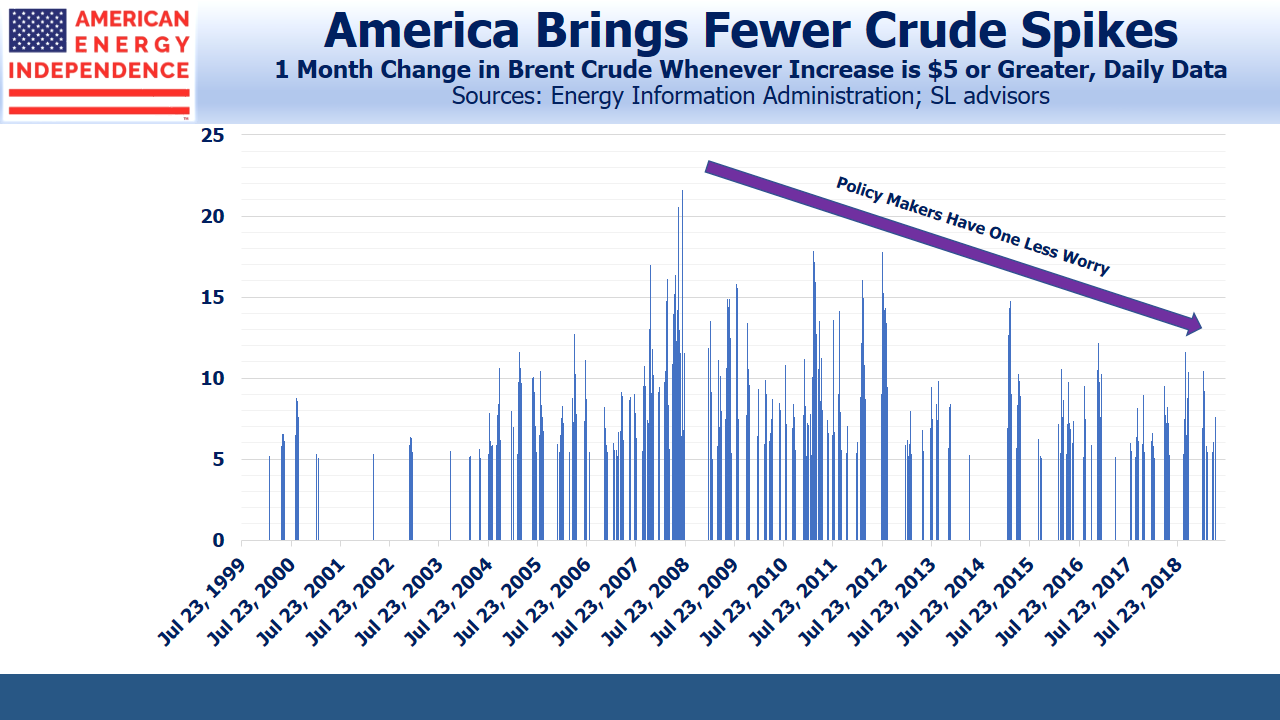

Ratcheting up the price of crude oil may be one of the few levers Iran holds over President Trump in an election year. So far, oil traders have been surprisingly sanguine about the prospects of supply disruption. Following September’s attack on Saudi infrastructure, oil retraced its initial jump within a couple of weeks, as supply was quickly restored. Some analysts believe that the recent jump in prices won’t be sustained without an actual loss of supply. The Shale Revolution has enhanced America’s freedom to act.

However, given the domestic American politics of rising gas prices, a series of moves to interrupt supply would seem to be one of few meaningful strategies left to Iran. Attacks on fixed targets will draw a U.S. response, but if shipping insurance rates rise and the smooth transport of oil around the world becomes less certain, Iran may yet find it has some leverage and buy it time until the US election.

The problem Iran’s leadership now faces is that it has raised expectations domestically for a robust response, but its choices remain limited. Meanwhile, Trump has shown he’s not interested in nation building or committing U.S. land forces. He has established a clear red line that the loss of American lives won’t be tolerated. Cruise missiles and drones allow the U.S. to pursue remote yet devastating engagement with minimal risk. Crippling economic sanctions continue to hurt the Iranian population.

Iran’s current approach of low-level, asymmetric attacks has also failed to achieve their goals They may have overplayed their hand, and are now left with few options. A direct military response risks heavy-handed retaliation, while small provocations through proxies expose Iran’s leaders personally. It’s unclear how Iran’s government can lower tensions, and little evidence they want to.

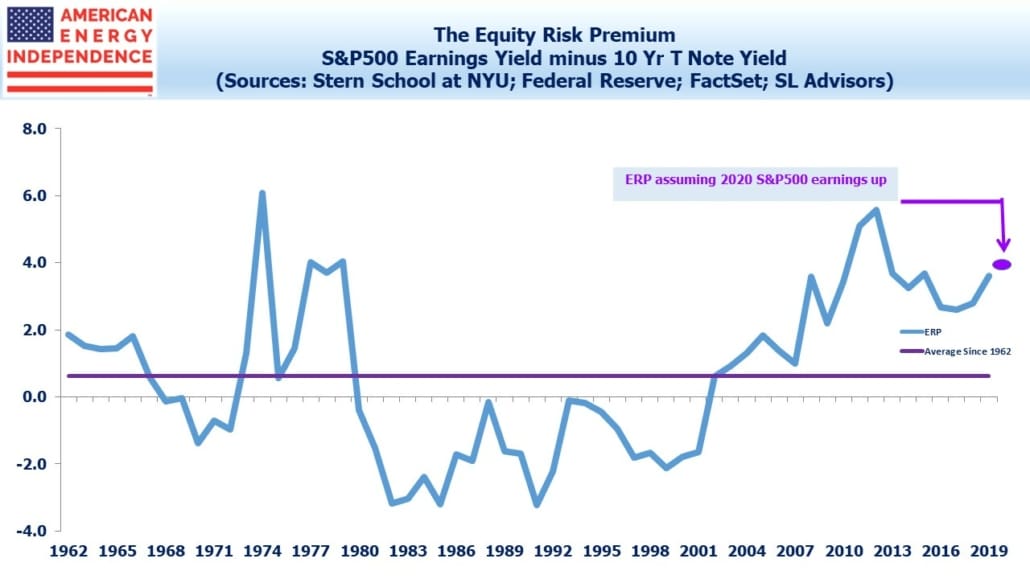

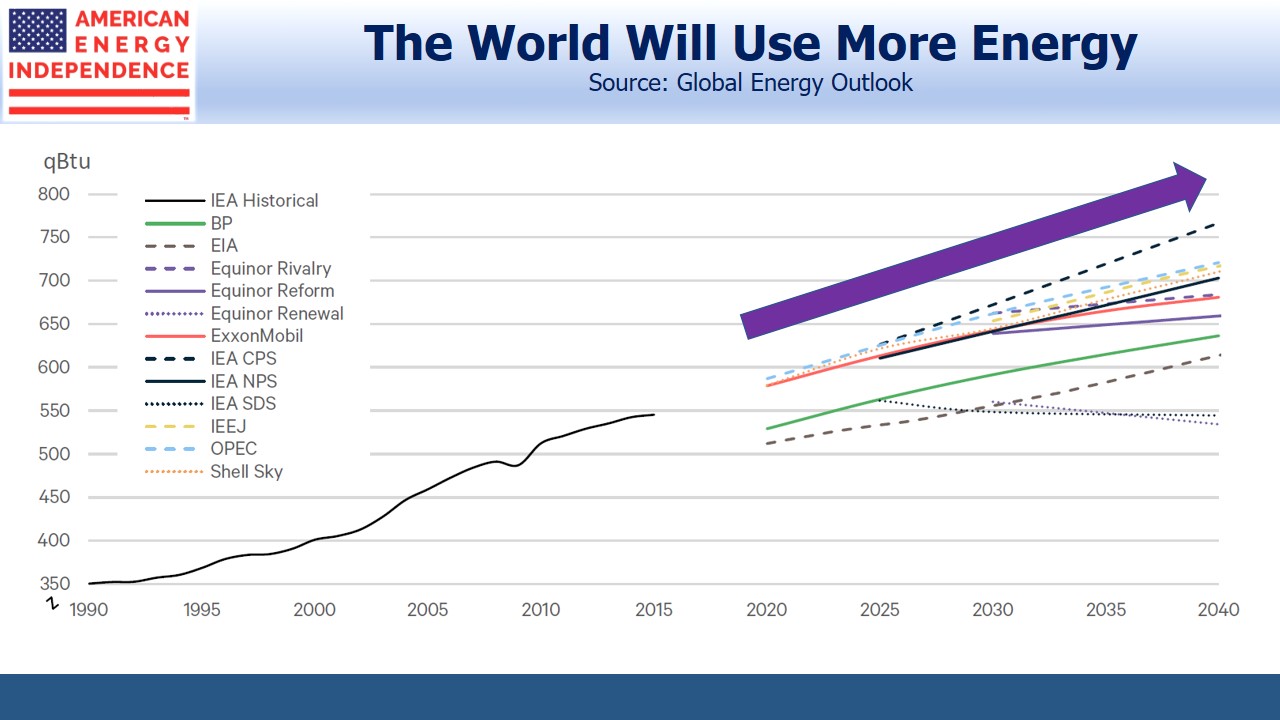

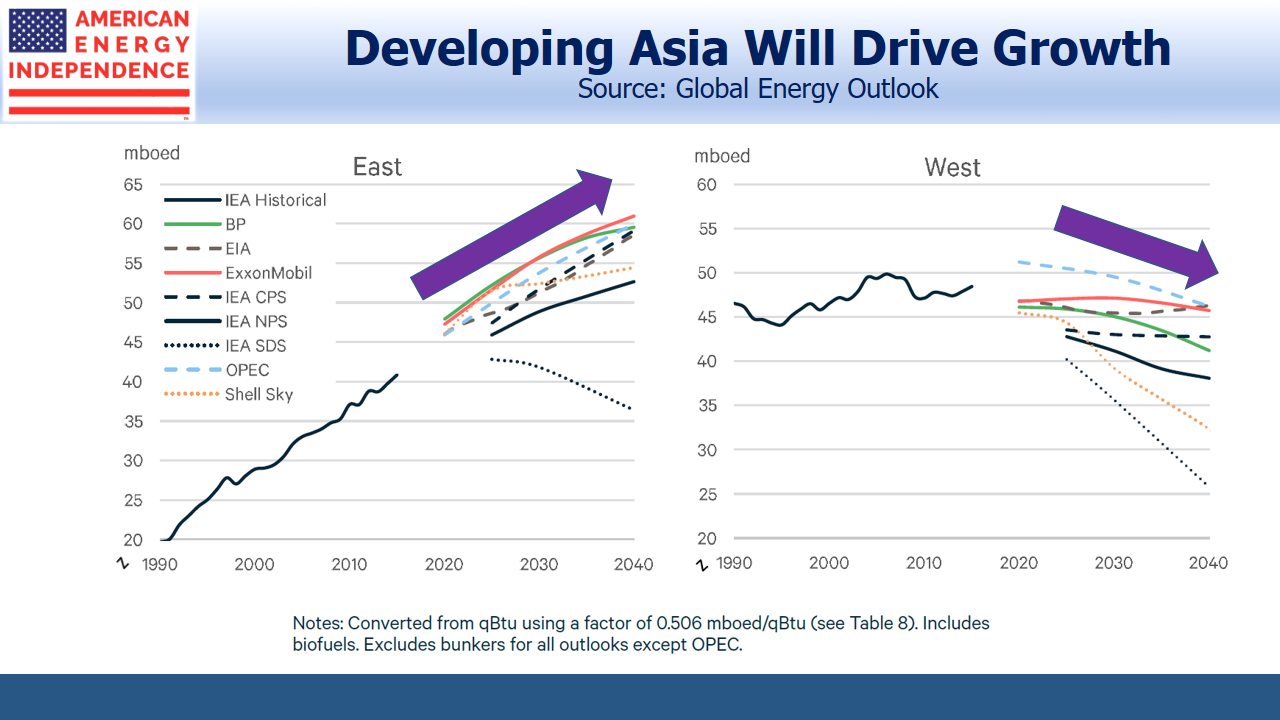

Trump’s killing of Suleimani highlights how unpredictable the conflict has become. Energy investments are a good insurance policy. The past decade’s underperformance against the S&P500 has left many investors underweight, and lowered the sector’s correlation with the rest of the market. Oil prices don’t yet price much risk premium. Midstream energy infrastructure’s growing free cash flow (see The Coming Pipeline Cash Gusher) is well beyond Iran’s reach, and offers a highly likely outcome in a period of uncertainty.