ETFs and Behavioral Finance

There are over three million stock indices in the world, more than 70 times as many as actual stocks. Before learning this startling fact in the FT the other day, I might have guessed wildly at 1% of this figure, thinking it way too high.

Although the growth in Exchange Traded Funds (ETFs) is not solely responsible for this index explosion, it’s certainly helped. The move away from active management has spurred the creation of indices into which passive funds can invest. At SL Advisors we recently made our own modest contribution to this thee million number by launching the investable American Energy Independence Index, in partnership with S&P Dow Jones Indices. Launching an index involves substantial work, but unlike an IPO there’s no 6% underwriting fee. Starting an index is cheaper than floating a stock.

The Shale Revolution has transformed America’s term of trade in energy, and created substantial opportunities for the infrastructure businesses who will help us towards Energy Independence. We identified a gap in the marketplace, since none of the available investment products offer exposure to this theme. A new index and associated ETF soon followed.

So it was that your blogger was at the Inside ETFs conference in Hollywood, FL last week. It’s an enormous event with (so we were told) a record 2,300 attendees. It’s a tangible measure of the growth in ETFs, marked by the S&P500 ETF (SPY) conveniently breaching the $300BN market capitalization threshold. The global ETF industry is over $4TN.

Non-investment luminaries such as Serena Williams and General Stan McChrystal added star power to the long list of finance experts giving presentations all day. We didn’t see any of them, because Inside ETFs is an enormous networking event. It’s become the can’t miss date of the year for everybody in the industry. Meetings with business partners and clients took up much of our planned schedule before arriving, and unexpected encounters filled the rest. You really can sit in the convention center lobby and enjoy serial, chance meetings with familiar faces.

The chatter is of success; of funds that generated strong early returns and have grown quickly. Of hot areas (Smart Beta), and underserved sector (European fixed income, believe it or not). It is Behavioral Finance in action. Positive results generate confidence, attracting more assets and more confidence. The winners keep winning. There’s no care for the unloved ETF. Efficient markets proponents hold that there ought to be no serial correlation in returns – in other words, no momentum. Prices reflect all available information, so short term moves are random. In the real world, rising prices attract more buyers, and falling prices draw more selling. This is why markets exhibit momentum, because like-minded people congregate to create a positive feedback loop.

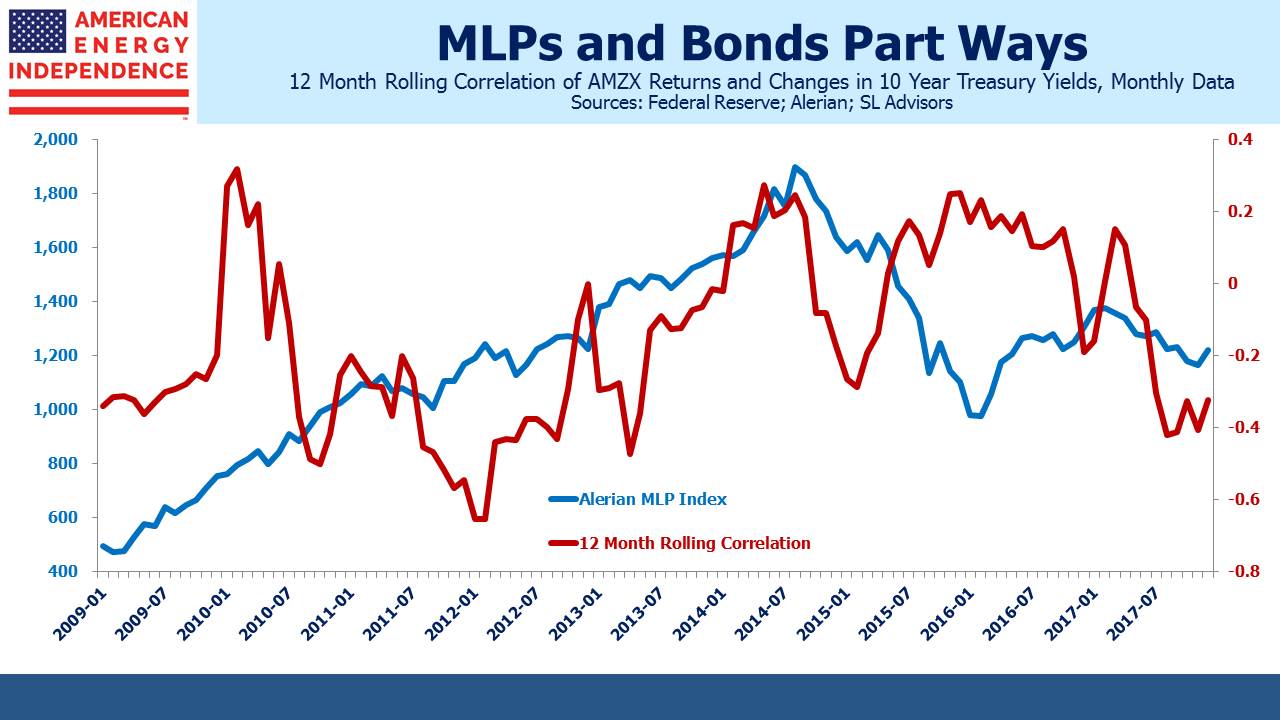

Energy infrastructure endured the inverse of this for much of last year, as the growing divergence against almost all other sectors became self-reinforcing. Until late November, when the last frustrated tax-loss sellers exited stage left, signaling the beginning of a new trend.

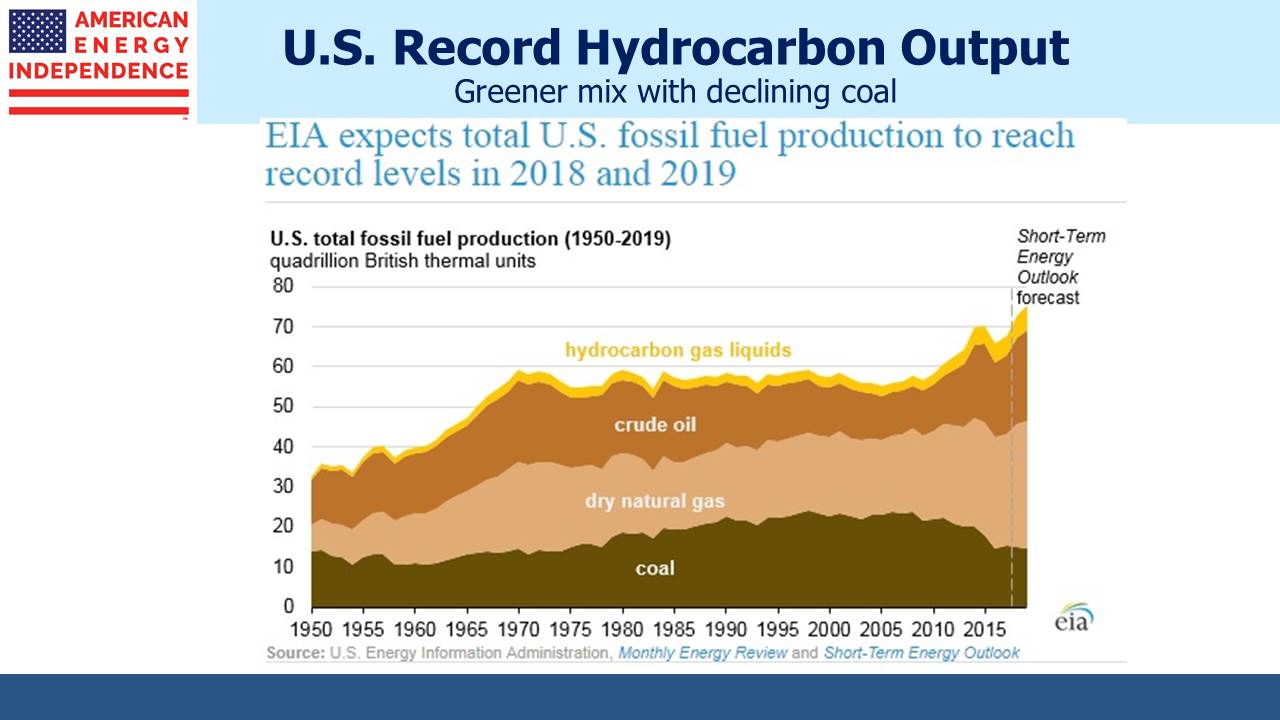

In other news, U.S. crude output is set to reach an all-time record in 2018. You’d think it’d be hard to turn this into bad news, unless you’re a Russian oil producer/ But apparently there is a Dark Side of America’s Rise to Oil Superpower, according to Bloomberg BusinessWeek. Problems include the high quality of shale oil, which is lighter than the heavy crudes it’s displacing from countries such as Venezuela. This means it needs less refining. Although refineries may find certain expensively built processes no longer needed, ultimately producing refined products from it is cheaper. This is bad? Sounds like fake news; maybe the Russians planted the story.

The investable American Energy Independence Index (AEITR) finished the week +2.0%. Since the November 29th low in the sector, the AEITR has rebounded 15.0%.