Energy Transfer Shows Who's the Boss

Ten days ago, investors in Energy Transfer Partners (ETP) were content with a high distribution yield of 11%, albeit with little growth and (if they were honest with themselves) some risk of a cut in the future. Investors in Sunoco Logistics (SXL) had similarly come to terms with a 7.6% yield bolstered by the prospect of high single digit growth. The buyers of each security had self-segregated to the combination of current income and growth prospects that suited them.

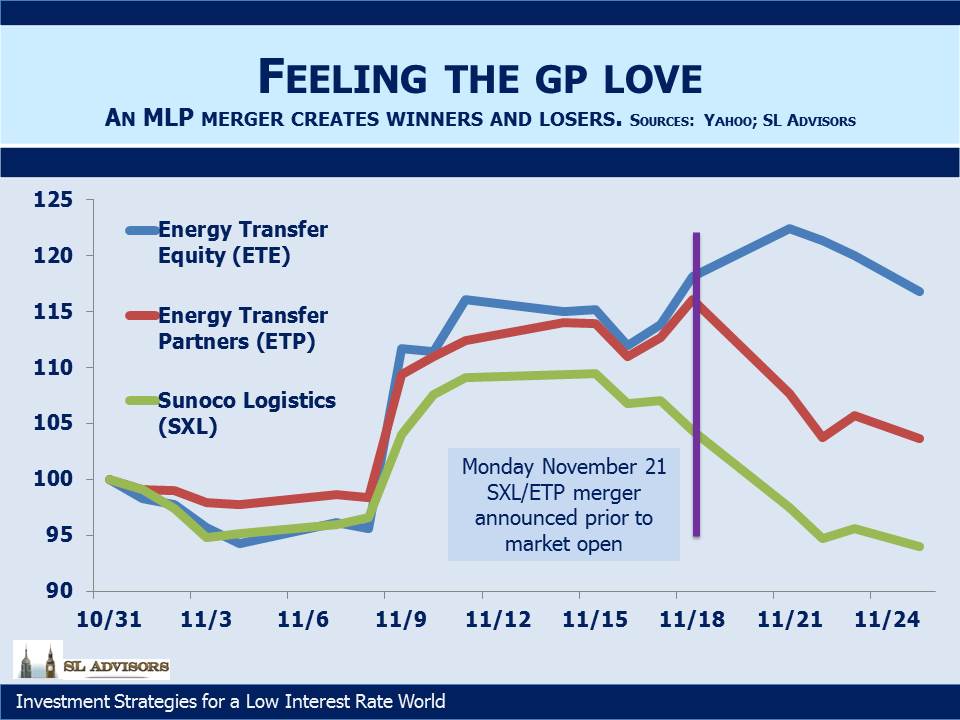

Once again, Energy Transfer Equity (ETE) CEO Kelcy Warren has surprised, creating sharp price movements and fresh blog material in the process. As General Partner (GP) of ETP and SXL, ETE controls them both, and that control was on full display. So it is that SXL is acquiring ETP, upsetting the basis on which investors in both securities had made their decisions. ETP investors currently receive a $4.22 annual distribution. In exchange for their ETP units they’ll receive 1.5 SXL units. SXL pays a $2.04 distribution, so the new $3.06 distribution (i.e. $2.04 X 1.5) represents a 27.5% cut for ETP investors. They weren’t happy.

Meanwhile, SXL’s high single digit distribution growth prospects may now be challenged following its combination with the slower-growing ETP assets, although the $200MM in annual operating synergies will help. In short, ETP and SXL investors will both shortly own something different than they bought. If ETP investors had favored growth over income they would have already held SXL. It was a demonstration that Limited Partners (LPs) in MLPs are limited in more ways than one.

Both ETP and SXL were down sharply once the deal was announced. It’s not an obviously bad transaction, and Kelcy Warren made a good case for the combination on a conference call later the day of the announcement. It just imposes a different return profile on current investors than they sought. So there will probably be some turnover as the unhappy sell their holdings to the optimistic.

The winners include ETP bondholders, since less cash paid to equity holders in the form of distributions means improved debt coverage. The other winner is ETE, which shouldn’t be surprising because that’s where Kelcy Warren invests his money. Although near term Distributable Cash Flow (DCF) to ETE will be lower than before, since distributions to the former ETP investors will be lower, it makes the Incentive Distribution Rights (IDR) forgiveness that ETE has extended likely to lapse within a couple of years rather than possibly continuing on. The new SXL will be larger and more diversified, which should in time lead to a lower cost of capital.

We’re invested in ETE, alongside management because that’s what we do. Even that close alignment doesn’t always guarantee success; earlier this year we noted how Kelcy Warren issued new convertible preferreds to himself and the management team that gave them the ability to reinvest dividends at a fixed, low price of ETE (see Is Energy Transfer Quietly Fleecing its Investors?). As a result, Kelcy is regularly buying new ETE units at $6.56 each, the level they hit earlier this year because of his ill-advised pursuit of Williams Companies (WMB), even though the collapse of that transaction and subsequent rebound in the sector has taken ETE back as high as $18.

Investors in ETE are there rather than ETP or SXL precisely because we understand the favorable asymmetry that benefits the GP. The dilution of ETE investors that these convertible preferreds causes was therefore a bitter pill for the non-management ETE investors to swallow. A class action lawsuit followed (Energy Transfer Equity LP Unitholder Litigation), in which the plaintiffs alleged these securities unfairly transferred wealth from them to management. Based on reviewing the transcript of oral arguments earlier this month, the memorably named Judge Glasscock appears to be sympathetic to this claim although allowed that he needs to study the relevant documents before ruling. If the offending securities are cancelled as they should be, a future transfer of well over $1BN in ETE interests to management will not take place.

Faced with the prospect of investing in someone who so easily abandons his fiduciary obligation to his investors, we were tempted to give up on ETE. However, they’re a smart management team and fortunately we allowed our commercial instincts to trump our principles. It’s what Kelcy would have done.