The Limited Rights of Some MLP Investors

Examining the Risk Factors in a company’s 10-K is not everybody’s idea of light entertainment, but as you’ll see below it can provide useful insight about how management may treat certain of its stakeholders.

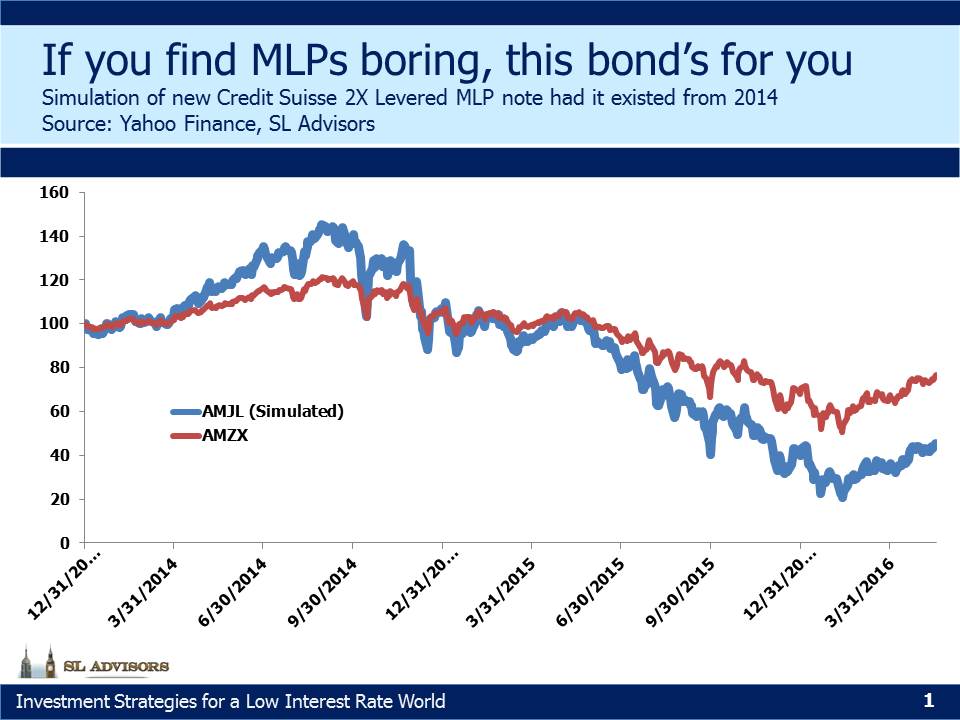

Many Master Limited Partnerships share a legal structure that is similar to hedge funds and private equity funds, in that the investors put their money in the fund whereas the manager gains most of his wealth from controlling the General Partner (GP). MLP investors don’t think of themselves as hedge fund investors, and to be sure the 9% ten year annual return on the Alerian Index is far better (for example, the HFRI Fund-Weighted Composite Index has only managed 3.3%), including as it does both the 2008 Financial Crisis and the 2015 MLP Crash.

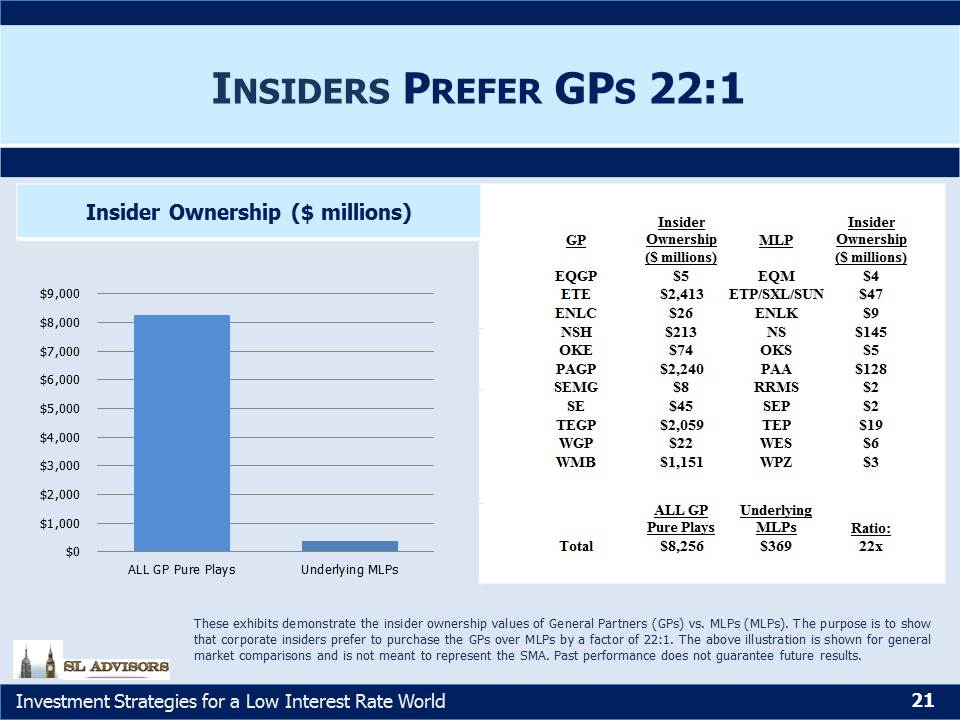

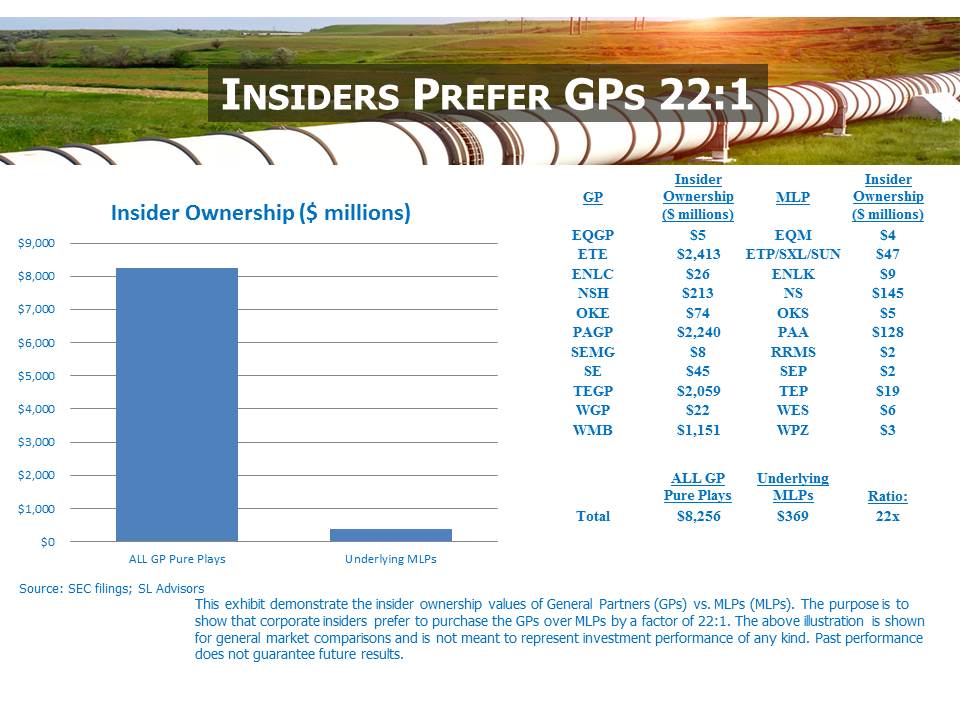

But from the perspective of governance rights, MLP investors do look a lot like the passive Limited Partners (LPs) in these other asset classes. They surrender many of the rights taken for granted by equity investors in public corporations. Here are some examples lifted directly from the relevant 10-K. It’s one of the reasons why MLP managements typically invest in the MLP GP rather than the MLP itself, and it’s why we do too.

Williams Partners (WPZ)

“Our general partner has limited duties to us and it and its affiliates, including Williams and Access Midstream Ventures, and may have conflicts of interest with us and may favor their own interests to the detriment of us and our common unitholders.”

“…Williams’ directors and officers have a fiduciary duty to make decisions in the best interests of the owners of Williams, which may be contrary to our best interests and the interests of our unitholders.”

“Except in limited circumstances, our general partner has the power and authority to conduct our business without unitholder approval.”

“Our general partner may cause us to borrow funds in order to permit the payment of cash distributions, even if the purpose or effect of the borrowing is to make incentive distributions.”

“Our partnership agreement limits our general partner’s duties to unitholders and restricts the remedies available to such unitholders for actions taken by our general partner that might otherwise constitute breaches of fiduciary duty.”

“Holders of our common units have limited voting rights and are not entitled to elect our general partner or its directors, which could reduce the price at which the common units will trade.”

“Even if public unitholders are dissatisfied, they have little ability to remove our general partner without the consent of Williams.”

“Our partnership agreement restricts the voting rights of unitholders owning 20 percent or more of our common units.”

Explanation: The management of WPZ has no fiduciary obligation to WPZ LPs, can cause WPZ to borrow money in order to pay management, and can’t be fired.

Plains All American (PAA)

“Unitholders may not be able to remove our general partner even if they wish to do so.”

“…generally, if a person acquires 20% or more of any class of units then outstanding other than from our general partner or its affiliates, the units owned by such person cannot be voted on any matter.”

Explanation: You can’t fire the management of PAA either.

Energy Transfer Partners (ETP)

“Unitholders have limited voting rights and are not entitled to elect the General Partner or its directors. In addition, even if Unitholders are dissatisfied, they cannot easily remove the General Partner.”

“Unlike the holders of common stock in a corporation, Unitholders have only limited voting rights on matters affecting our business, and therefore limited ability to influence management’s decisions regarding our business.”

“Furthermore, if the Unitholders are dissatisfied with the performance of our General Partner, they may be unable to remove our General Partner. The General Partner generally may not be removed except upon the vote of the holders of 66 2/3% of the outstanding units voting together as a single class, including units owned by the General Partner and its affiliates. As of December 31, 2015, ETE and its affiliates held approximately 0.5% of our outstanding Common Units and our officers and directors held less than 1% of our outstanding Common Units. Furthermore, Unitholders’ voting rights are further restricted by the partnership agreement provision providing that any units held by a person that owns 20% or more of any class of units then outstanding, other than the General Partner and its affiliates, cannot be voted on any matter.”

Explanation: You can’t put the people you’d like in senior management positions, and you can’t fire us.

These three names were selected simply because they’re well-known. Such provisions are not uncommon, and they do at least provide plain disclosure. If you’re not happy with your private equity manager you have very limited recourse; you can’t easily fire him and you have to wait for liquidity events to get your money back. At least if you dislike the management of your MLP you can sell your position.

Like the management teams that run these three MLPs, we are invested in the GPs of these as well as others. We are generally supportive of the people that run them, although we withhold judgment for now on one (see Is Energy Transfer Quietly Fleecing its Investors?). Even if you don’t expect management to fully avail themselves of the powers they’ve granted themselves, it’s good to know what those powers really are.

We are invested in Williams Companies (WMB), Plains GP Holdings (PAGP) and Energy Transfer Equity (ETE).

Please note publication of our June newsletter will be delayed by a few days as I’ll be attending the 2016 MLP Investor Conference in Orlando.